BSEB Bihar Board 12th Accountancy Important Questions Long Answer Type Part 2 are the best resource for students which helps in revision.

Bihar Board 12th Accountancy Important Questions Long Answer Type Part 2 in English

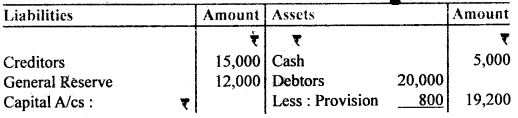

Question 1.

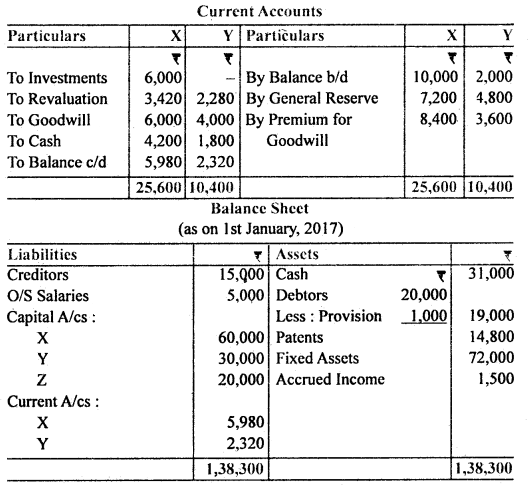

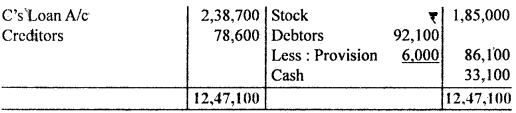

X and Y are partners. They share their profit – loss in the ratio of 3 : 2. On 31st December 2016 their position was as follows:

They admit Z on the following terms:

- A provision of 5% is to be created on debtors.

- Accrued income of ₹ 1,500 does not appear in the books and ₹5,000 are outstanding for salaries.

- The present market value of investments is ₹ 6,000. X takes over the investments at this value.

- The New Profit – sharing ratio of partners will be 4 : 3: 2. Z will bring in ₹ 20,000 as his capital.

- Valuation of goodwill would be on the basis of two years purchase of average profit Z is to pay in cash an amount equal to his share in the firm’s goodwill. The profits of the last 3 years were ₹ 30,000; ₹ 26,000 and ₹25,000 respectively.

- Half of the amount of goodwill is withdrawn, by old partners.

Prepare Revaluation A/c, Capital A/cs, Current A/cs and the Opening balance Sheet of the new firm.

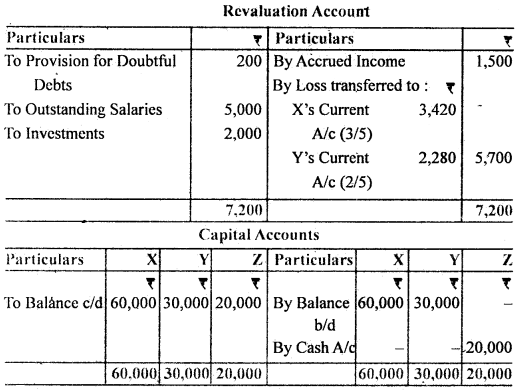

Answer:

Working Notes:

1. Sacrificing Ratio = Old Ratio – New Ratio

X = \(\frac{3}{5}-\frac{4}{9}\) = \(\frac{27-20}{45}=\frac{7}{45}\)

Y = \(\frac{2}{5}-\frac{3}{9}\) = \(\frac{18-15}{45}=\frac{3}{45}\)

7/45 : 3/45 = 7 : 3

X’s Share of Goodwill = 12,000 × \(\frac{7}{10}\) = ₹ 8,400

Y’s Share of Goodwill = 12,000 × \(\frac{3}{10}\) = ₹ 3,600

| Calculation of Cash: | ₹ |

| Opening balance | 5,000 |

| Z’s Capital | 20,000 |

| Goodwill(brought) | 12,000 |

| Goodwill(withdrawn) | (6,000) |

| Total | 31,000 |

Question 2.

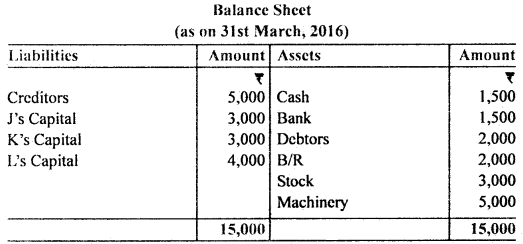

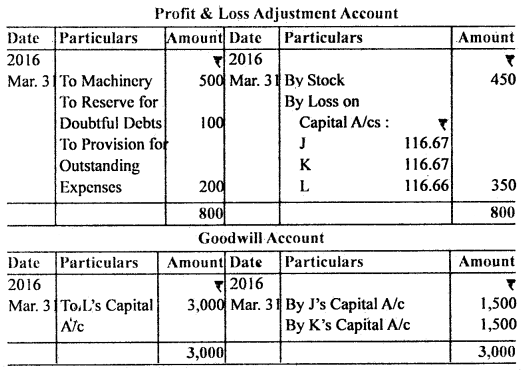

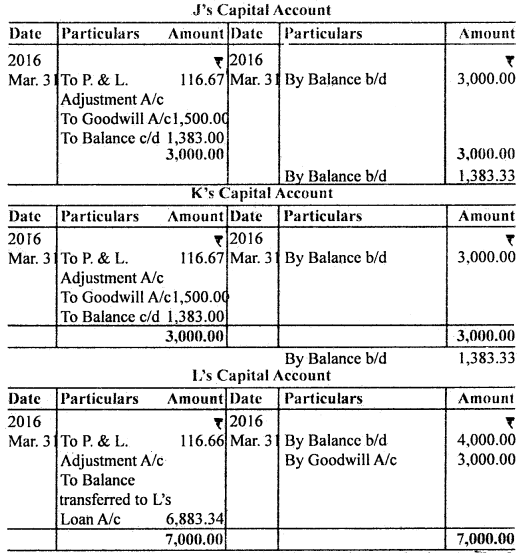

The following is the Balance Sheet of J.K.L. on 31st March 2016:

L retires and the following adjustments are made.

(a) L’s share of Goodwill will be valued at ₹ 3,000 which is written back to the remaining Partner’s Capital A/c.

(b) Stock is to be appreciated by 15%.

(c) Machinery is to be depreciated by 10%.

(d) 5% Reserve to be made for doubtful debts.

(e) Provision of ₹ 200 is to be made for outstanding expenses.

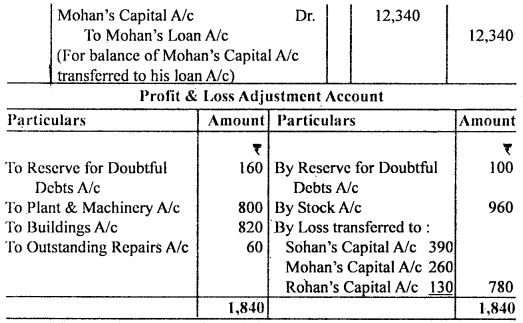

Prepare Profit & Loss Adjustment Account, Goodwill Account and Partner’s Capital A/cs.

Answer:

Profit & Loss Adjustment Account

Question 3

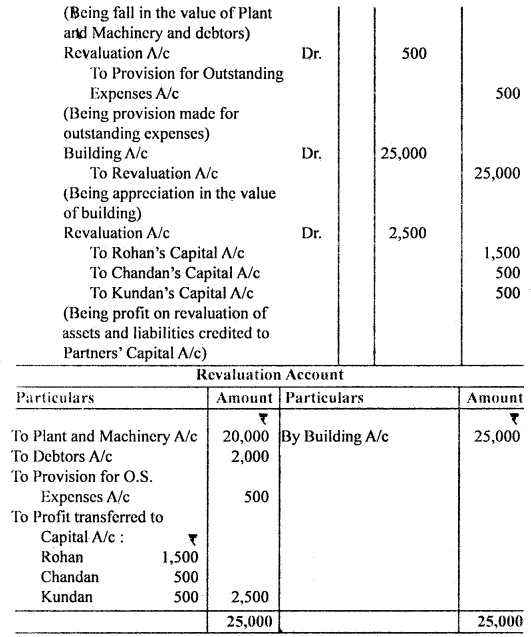

Rohan, Chandan and Kundan are partners sharing profits & losses in the ratio of 3: 1: 1. Rohan retires from the firm. On the date of his retirement Plant and Machinery which stood in the books at ₹ 1,00,000 was valued at ₹ 8,000, Debtors are ₹ 2,000 less than the book value of ₹ 20,000 and Building of ₹ 1,00,000 was valued at ₹ 1,25,000. A provision of ₹ 500 was made for outstanding expenses.

Pass the necessary journal entries for the above and prepare Revaluation Account.

Answer:

Question 4

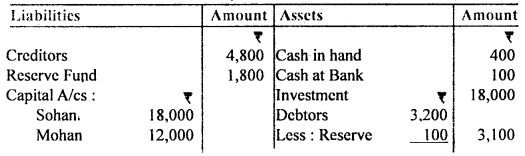

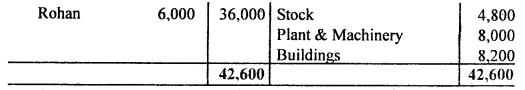

Sohan, Mohan and Rohan were in the partnership sharing profits in the proportion of 1/2, 1/3 and 1/6 respectively. The Balance Sheet of firm as of 31st March 2016 stood as follows:

Mohan retires on 1st April 2016 and the following adjustments are agreed upon:

Reserve for doubtful debts is to be made at 5% of debtors, Stock is to be appreciated by 20%, Plant and Machinery and Building is to be depreciated by 10%. A bill for ₹ 60 was outstanding repairs. You are requested to pass necessary Journal entries and prepare Profit & Loss Adjustment A/c.

Answer:

Question 5

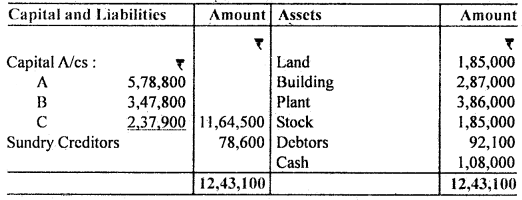

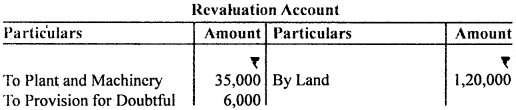

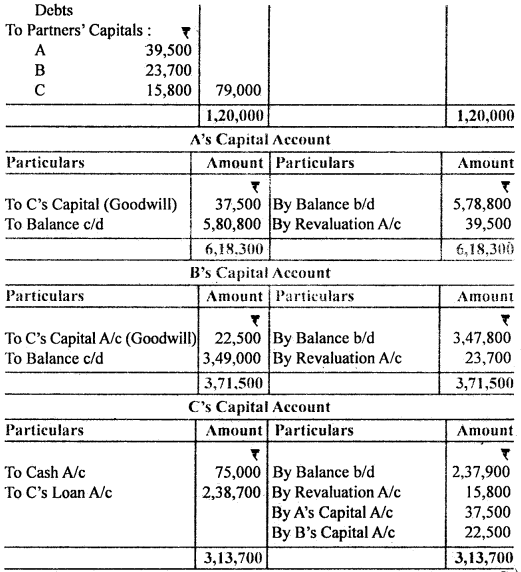

The Balance Sheet of A, B and C who were sharing profits in the ratio of 5 : 3: 2 is given below as of 31st March 2016.

Cretired on the above data, on the following terms:

- The land was undervalued by ₹ 1,20,000.

- The plant was overvalued by ₹ 35,000.

- Provision for doubtful debts was required for ₹ 6,000.

- Goodwill of the firm is valued at ₹ 3,00,000. Partners decided not to show this value in the books.

C was paid 75,000 immediately and the balance amount was to be transferred to his loan account. Make Revaluation A/c, C’s Capital A/c and Balance Sheet.

Answer:

Working Notes:

- Value of Goodwill = ₹ 3,00,000; C’s share of Goodwill = \(\frac{2}{10}\) × 3,00,000 = ₹ 60,000

- Since the new profit ratio is not given, the old ratio will continue between A and B. As a result, the new ratio will be % : 3 and the graining ratio will be 5 : 3.

- A’s contribution towards the goodwill payable to C = 60,000 × \(\frac{5}{8}\) = ₹ 37,500

B’s contribution towards the goodwill payable to C = 60,000 × \(\frac{3}{8}\) = ₹ 22,500

Question 6

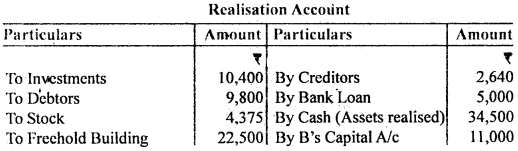

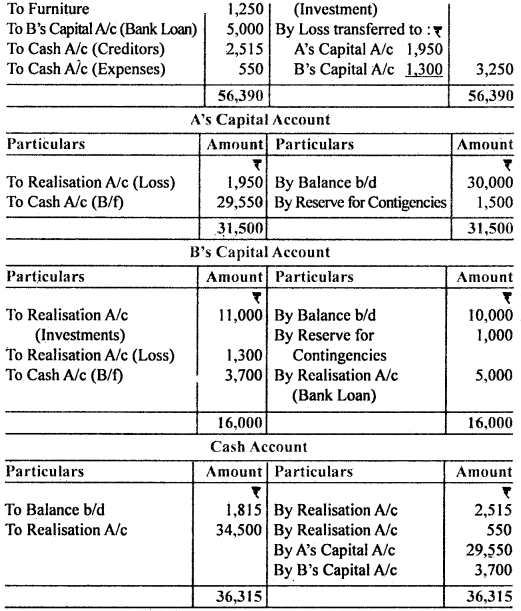

A and B are in partnership sharing profits and losses in the proportion of 3/5 and 2/5. The following was their Balance Sheet as of 31st March 2016:

They decided to dissolve the partnership on this date and the assets, with the exception of the investment and cash, were sold for ₹ 34,500. The market value of the investment was ₹ 11,000 which was taken over by B who also agreed to discharge the Bank loan.

Answer:

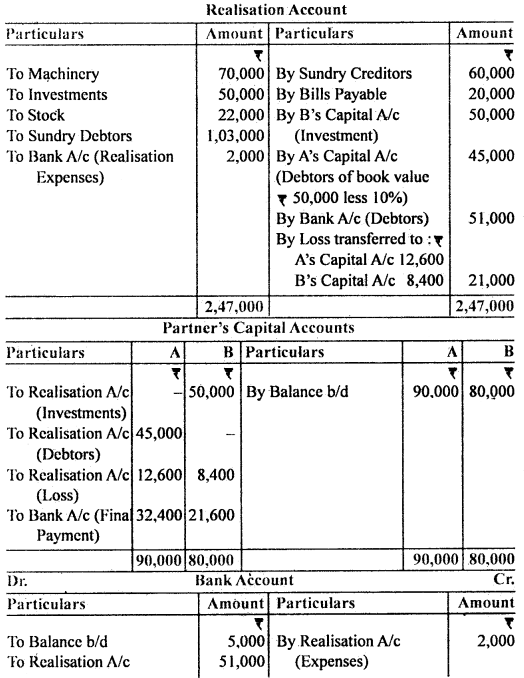

Question 7.

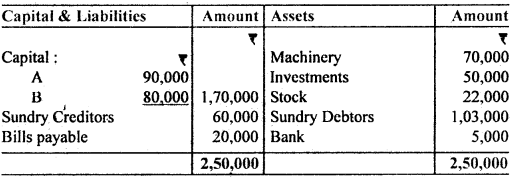

A and B are partners in the firm and sharing profits and losses as 3: 2. They decided to dissolve their firm. On March 31, 2016, their Balance Sheet was as follows:

The Assets and Liabilities were disposed of as follows:

(i) Machinery were given to the creditors in full settlement to their account and stock were given to bills payable in full settlement.

(ii) Investment was taken over by B at book value. Sundry debtors having a book value of ₹ 50,000 were taken over by A at 10% less and from remaining debtors ₹ 51,000 were realised.

(iii) Realisation expenses amounted to ₹ 2,000.

Prepare necessary ledger accounts to close the books of the firm.

Answer:

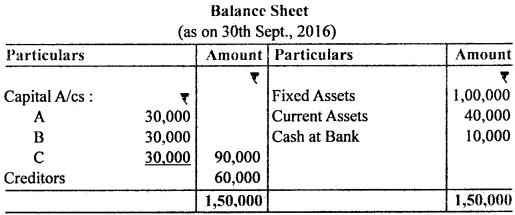

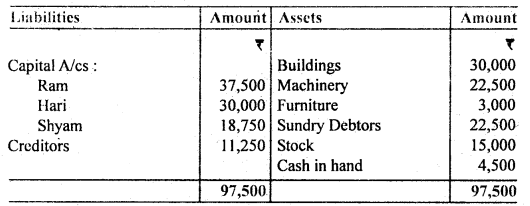

Question 8.

A B and C are partners sharing profits and losses equally. They dissolve the firm on 30th Sept. 2016 on which date their position was as under:

All the assets realised 10% less than book value. Creditors were paid in full. Expenses of realisation amounted to ₹ 500 and a contingent liability for which no provision was made ₹ 500 was paid for it.

Prepare (i) Realisation A/c, (ii) Partners Capital A/cs, (iii) Bank A/c.

Answer:

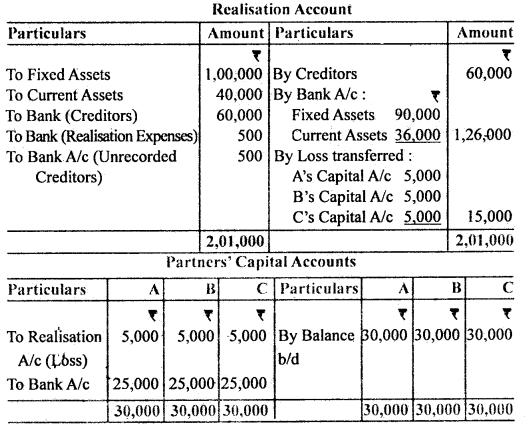

Question 9.

Ram, I lari anti Shy am are partners in a jinn sharing profits and losses in the ratio 6:5: 4. On 1st April 2016 they decided to dissolve the line. On that date, their Balance Sheet was as ahead:

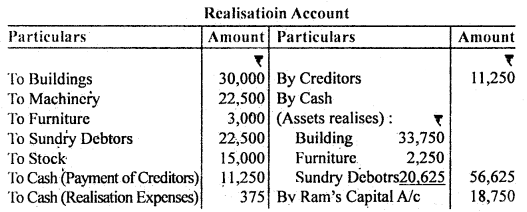

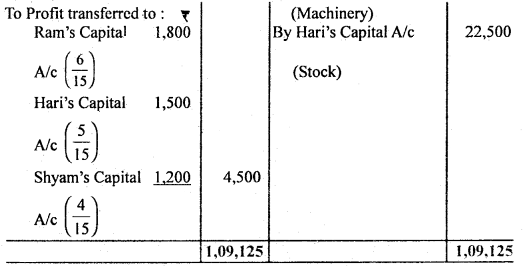

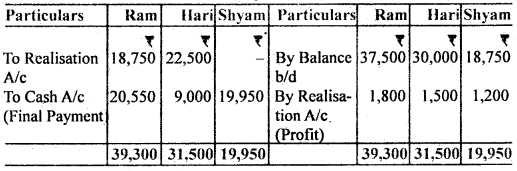

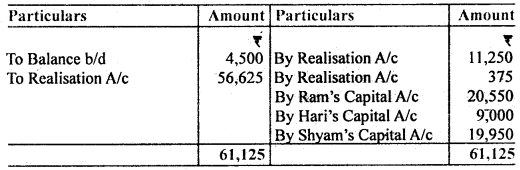

The assets were realised as follows:

Building ₹ 33,750, furniture ₹ 2,250, Sundry debtors ₹ 20,625. Ram took machinery for ₹ 18,750 and Hari purchased Stock for ₹ 22,500.₹ 375 was spent on realisation.

Prepare Realisation Account, Cash Account and Capital Accounts of the partners.

Answer:

Partner’s Capital accounts

Cash Account

Question 10.

What is a Realisation Account? Give its format and distinguish – between Revaluation Account and Realisation Account.

Answer:

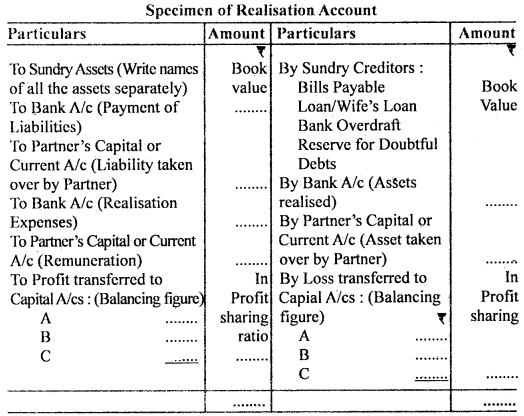

Realisation Account:

- Realisation Account is opened on the dissolution of the firm.

- ‘Realisation Account’ is a Nominal Account. It is opened for disposing of. of all the assets of the firm and making payment to all the liabilities and dissolution expenses.

- Its object is to find out the profit or loss on the realisation of assets and payment of liabilities.

- The Profit or loss on realisation is distributed among all partners in their profit-sharing ratio.

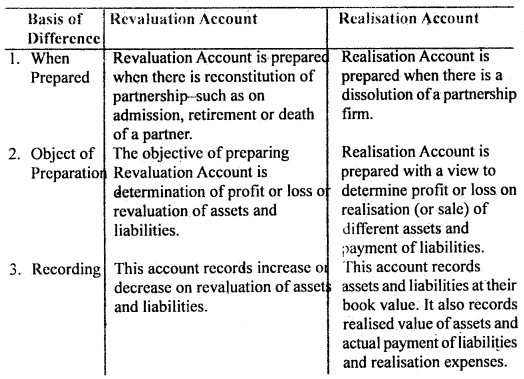

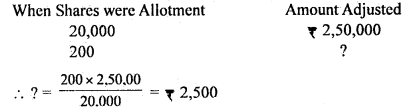

Difference between Revaluation Account and Realisation Account The following are the main points of difference between Revaluation Account and Realisation Account:

Question 11.

What is the forfeiture of shares? What Journal entries are passed in the case of forfeiture and reissue of forfeited shares? Give example.

Answer:

Meaning of Forfeiture of Shares: The term ‘forfeit means taking away a thing or property on breach of a condition or default. A shareholder is liable to pay all the calls made by the company within the stipulated time. If one or more shareholders fail to pay allotment and/or calls on the due dates, they are said to be in default.

In such a situation, the company may serve notice to such shareholder or shareholders to make payment within a given time. If, after a reasonable and stipulated time, the amount due is not received, such shares may be forfeited, to forfeit a share means to cancel the allotment of defaulting shareholders. Thus, forfeiture of shares means compulsory termination of membership. It also means the forfeiture of the amount already paid by the defaulting shareholders).

Accounting Treatment on Forfciturc of Shares

(A) Forfeiture of Shares Issued at par: If the shares are issued at par and forfeited due to non-payment of allotment or call, the following entry would be passed:

Share Capital A/c Dr, (With No. of shares forfeited × Amount called up per share).

To Share Forfeiture A/c (With the amount already received by the company)

To Share Allotment Unpaid Call A/c (With the amount not received on allotment)

( ……..shares forfeited for non-payment of share allotment and call money)

Note: If the unpaid calls have been transferred to Calls-in-arrear Account, Calls-in-arrear Account will be credited in place of Share Allotment and Share Call Account in case of forfeiture. Then the entry would be:

Share Capital A/c Dr. (No. of Shares × Called up Value per Share)

To Share Forfeiture A/c (Amount received)

To Calls-in-arrears A/c (Amount due but not paid)

(B) Forfeiture of Shares in case of Shares Issued at Premium: On the forfeiture of shares originally issued at a premium, there may be either of the following situations:

1. Share Premium received on Forfeited Shares: According to Section 78 of the Companies Act, ‘share premium’ once collected cannot be cancelled even if these shares are forfeited. The amount of premium already realised on such forfeited shares must remain in Securities Premium Account. It should not be transferred to forfeited Shares Account’.

Accounting Entry:

The accounting entry will be the same as the one passed in case of shares issued at par, i.e.,

Share Capital A/c Dr. (With amount called up × No. of shares forfeited)

To Share forfeiture A/c (With amount received)

To Share Call A/c (With amount unpaid on calls)

(For forfeiture of ………shares for non-payment on………….. call).

2. Share Premium not received on Forfeited Shares: If the shares were originally issued at a premium and the premium remains in arrear on forfeited shares the amount of such premium should be cancelled. The reason is that at the time of allotment or first call, as the case may be, the Securities Premium Account must have been credited. For cancelling the amount of premium not received on forfeited shares, the Securities Premium Account should be debited.

Accounting Entry:

Share Capital A/c Dr. (With amount called up × No. of shares forfeited)

Securities Premium A/c Dr. (With the amount of share)

(C) Forfeiture of Shares Issued at Discount: If the shares were originally issued at a discount and the ‘Discount on Issue of Shares Account’ was already debited, on forfeiture of such shares, such discount should be written off. This is done by crediting ‘Discount on Issue of Shares Account’.

Accounting Entry:

Share Capital A/c Dr. (With the amount called up)

To Share Forfeiture A/c. (With the amount already received)

To Discount on Shares A/c (With the discount on forfeited shares)

To Share Call A/c (With the number of unpaid calls)

(For …………shares forfeited for non-payment on ……)

Question 12.

Ranjana Ltd. issued 20,000 shares of if 100 each to the public at a premium of ₹ 20 per share payable as follows.

On Application and Allotment 50 (including premium) per share.

On the First and Final call 70 per share.

Applications were received for 30,000 shares. Applicants for 5,000 shares were rejected and a letter of regret was sent and their money was returned. The excess money of others was adjusted towards the amount due on calls. Call money on all shares was duly received except on 200 shares.

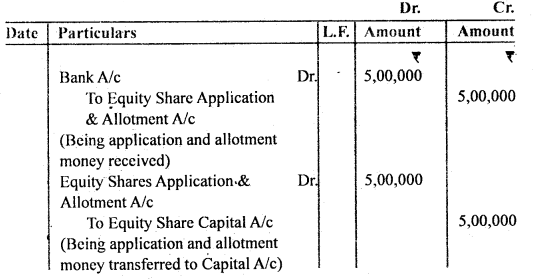

Make Journal entries in the books of the company for the above transactions.

Answer:

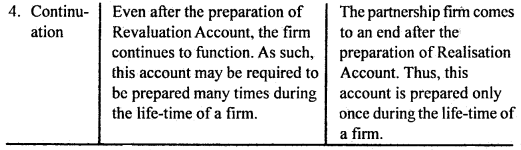

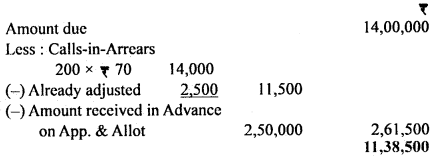

Working Note:

Excess amount adjusted towards due on first and final call: Share 5,000 × ₹ 50 = ₹ 2,50,000

When Shares were Allotment

Therefore, Amount received on the first and final call

Question 13.

An Ltd. makes on the issue of 10,000 equity shares of r 100 each, payable as follows:

On application and allotment ₹ 50

On first call ₹ 25

On final call ₹ 25

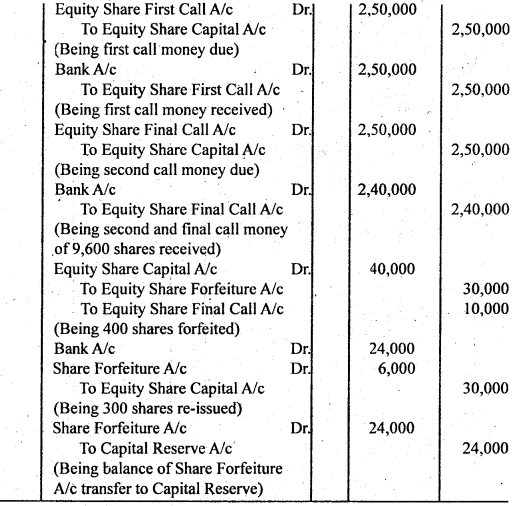

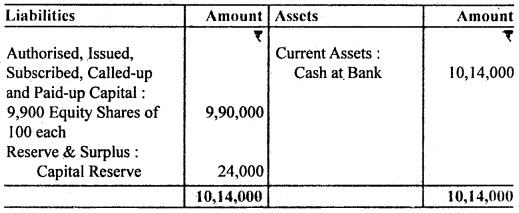

Members holding 400 shares did not pay the second call and shares are duly forfeited, 300 of which are re-issued as fully paid at ₹ 80 per share. Pass Journal entries in the books of the company. Also, prepare the Balance Sheet.

Answer:

Journal Entries in the Books of A Ltd.

Balance Sheet (as on…………)

Question 14.

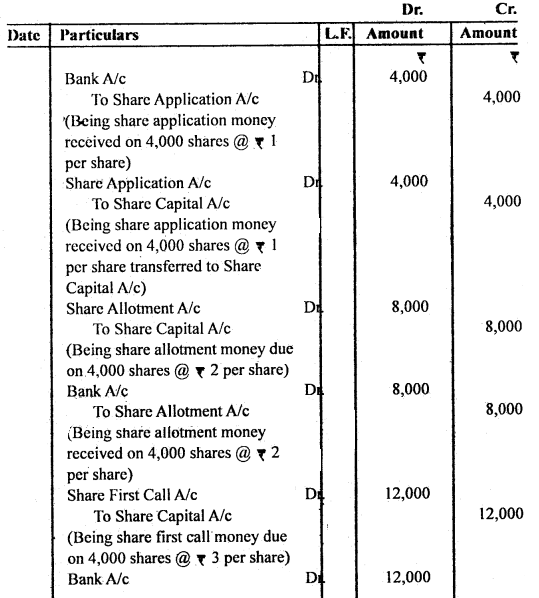

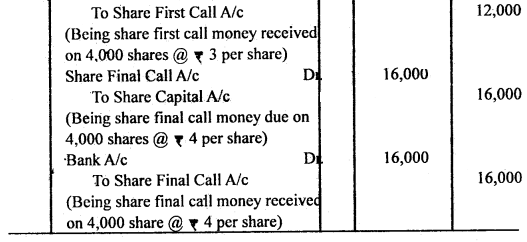

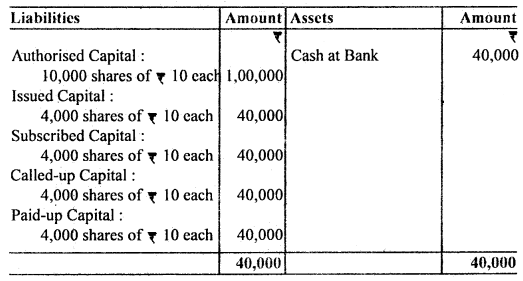

A Limited Company with registered capital of ₹ 1,00,000 divided into 10,000 shares of ₹ 10 each, issued 4,000 shares payable ₹ 1 per share on application, ₹ 2 on the allotment, ₹ 3 on the first call and the balance on final call. All payment was duly received. You are required to give Journal entries to record the above transactions and show the Company’s Balance Sheet.

Answer:

Journal Fnlrics in the Books of A Limited Company

Balance Sheet of A Limited Company (as on……………… )

Question 15.

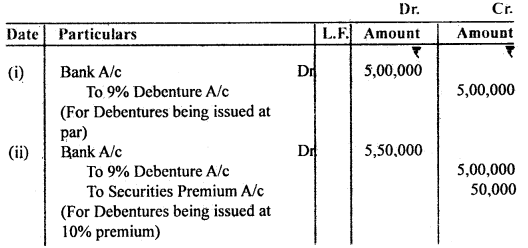

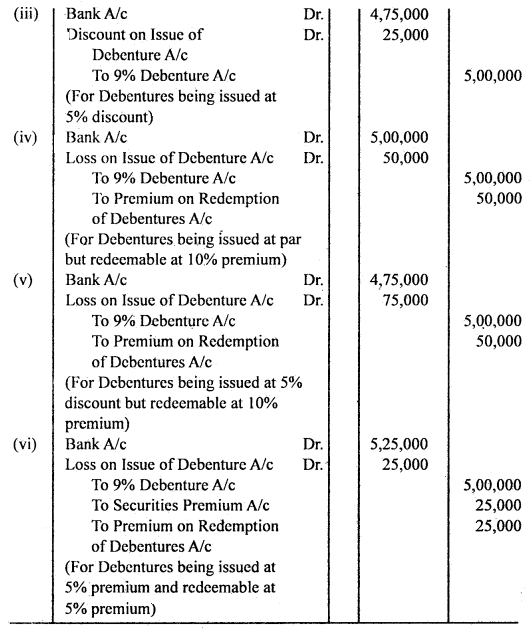

A Ltd. issued 5,000, 9% Debentures of j 100 each. Give Journal entries in the following cases:

(i) If the debentures are issued at par and are repayable at par.

(ii) If the debentures are issued at a premium of 10% and are repayable at par.

(iii) If the debentures are issued at a discount of 5% and are repayable at par.

(h) If the debentures are issued at par and are repayable at a premium of 10%.

(v) If the debentures are issued at a discount of 5% and are repayable at a premium of 10%.

(vi) If the debentures are issued at a premium of 5% and redeemable at a premium of 5%.

Answer:

Journal Entries