Bihar Board 12th Accountancy Objective Questions and Answers

Bihar Board 12th Accountancy VVI Objective Questions Model Set 3 in English

Question 1.

Income and Expenditure Account is prepared :

(A) By Trading Organisation

(B) By Industrial Organisation

(C) By Not-for-Profit Organisation

(D) By All Organisation

Answer:

(C) By Not-for-Profit Organisation

![]()

Question 2.

Donation received for specific objective will be shown:

(A) In Income and Expenditure A/c

(B) On Liabilities side of B/S

(C) On Assets side of B/S

(D) None of these

Answer:

(B) On Liabilities side of B/S

Question 3.

Payment of honorarium to Secretary is treated as :

(A) Capital Expenditure

(B) Revenue Expenditure

(C) Cash Expenses

(D) None of these

Answer:

(B) Revenue Expenditure

Question 4.

Preparation of Partnership agreement (Deed) is :

(A) Compulsory

(B) Voluntary

(C) Partly Compulsory

(D) None of these

Answer:

(B) Voluntary

Question 5.

Recording of an unrecorded liability on the reconstitution of a partnership firm will be:

(A) a gain to the existing Partners

(B) A loss to the existing Pamters

(C) Neither a gain nor a loss to the existing Partners

(D) None of these

Answer:

(B) A loss to the existing Pamters

Question 6.

Profit and loss on revaluation is borne by :

(A) Old Partners

(B) New Partners

(C) All Partners

(D) Only-two Partners

Answer:

(A) Old Partners

![]()

Question 7.

The old profit-sharing ratio among Rajender, Satish and Tejpal were 2:2:1. The new profit-sharing ratio after Satish’s retirement is 3:2. The gaining ratio is :

(A) 3 :2

(B) 2 : 1

(C) 1 : 1

(D) 2:3

Answer:

(C) 1 : 1

Question 8.

On the death of a partner, the amount of Joint Life Policy is credited to the Capital Accounts of:

(A) Only the deceased partner

(B) All partners including the deceeased partner

(C) Remaining partners, in the new profit sharing ratio

(D) Remaining partners, in their old profit sharing ratio

Answer:

(B) All partners including the deceeased partner

Question 9.

At the time of admission of a new partner general reserve appearing in the old Balance Sheet is transferred to:

(A) All Partner’s Capital A/cs

(B) New Partner’s Capital A/c

(C) Old Partner’s Capital A/cs

(D) None of these

Answer:

(C) Old Partner’s Capital A/cs

Question 10.

After transferring liabilities like creditors and bils payable in the realisation account in the absence of any information regarding their payment, such liabilities are treated as :

( A) Never paid

(B) Fully paid

(C) Partly paid

(D) None of these

Answer:

(B) Fully paid

Question 11.

Legacies should be treated as:

(A) Asset

(B) A Revenue Receipt

(C) A Capital Receipt

(D) None of these

Answer:

(C) A Capital Receipt

![]()

Question 12.

Donation received for general purpose will be shown :

(A) In Income and Expenditure A/c

(B) In Liabilities side of Balance Sheet

(C) In Assets side of Balance Sheet

(D) In none of these

Answer:

(B) In Liabilities side of Balance Sheet

Question 13.

Receipts and Payments Account usually indicates:

(A) Surplus

(B) Capital Fund

(C) Debit Balance

(D) Credit Balance

Answer:

(C) Debit Balance

Question 14.

In the absence of Partnership deed partners shall:

(A) be paid salaries

(B) not be paid salaries

(C) be paid salaries to those who work for the firm

(D) None of these

Answer:

(C) be paid salaries to those who work for the firm

Question 15.

The relation of a partner with the firm is:

(A) As a Manager

(B) As a Servant

(C) As an Agent

(D) None of these

Answer:

(C) As an Agent

Question 16.

Share of goodwill brought in cash by new partner is called:

(A) Profit

(B) Asset

(C) Premium

(D) Goodwill

Answer:

(D) Goodwill

![]()

Question 17.

Excess of credit side over the debit side in Revaluation Account is:

(A) Loss

(B) Gain

(C) Profit

(D) Expense

Answer:

(C) Profit

Question 18.

Insolvency of a partner leads to which type of dissolution ?

(A) Compulsory Dissolution

(B) Dissolution by Court

(C) Dissolution by Incidence

(D) None of these

Answer:

(B) Dissolution by Court

Question 19.

Income and Expenses A/c is a :

(A) Personal A/c

(B) Real A/c

(C) Nominal A/c

(D) None of these

Answer:

(C) Nominal A/c

Question 20.

(A) and (B) share profit in the ratio of 2 : 3. In future they decide to share profits in equal ratio. Which partner will sacrifice in which ratio ?

(A) A Sacrifices 1/10

(B) B Sacrifices 1/5

(C) B Sacrifice 1/10

(D) None of these

Answer:

(C) B Sacrifice 1/10

Question 21.

In which year the Partnership Act was passed ?

(A) 1932

(B) 1956

(C)2013

(D)1947

Answer:

(A) 1932

![]()

Question 22.

The sacrifice of old partners is :

(A) New Share-Old Share

(B) Old Share-New Share

(C) New Share

(D) Old Share

Answer:

(B) Old Share-New Share

Question 23.

If premium paid on Joint Life Policy is treated as business expenses, it appears in :

(A) P & L Account

(B) Balance Sheet

(C) Both

(D) None of these

Answer:

(A) P & L Account

Question 24.

When realisation expenses are paid by the firm on behalf of partner, such expenses are debited to :

(A) Realisation A/c

(B) Partners’ Capital A/c

(C) Partner’s Loan A/c

(D) None of these

Answer:

(A) Realisation A/c

Question 25.

For non-trading organisation honorarium is :

(A) Capital Expenditure

(B) Revenue Expenditure

(C) Income

(D) None of these

Answer:

(B) Revenue Expenditure

Question 26.

Income and Expenditure Account is :

(A) Personal Account

(B) Real Account

(C) Nominal Account

(D) None of these

Answer:

(C) Nominal Account

![]()

Question 27.

Life Membership Fees received by a club is shown in :

(A) Income & Expenditure A/c

(B) Balance Sheet

(C) Profit and Loss A/c

(D) None of these

Answer:

(B) Balance Sheet

Question 28.

Receipts and Payments Account is a :

(A) Personal Account

(B) Real Account

(C) Nominal Account

(D) None of these .

Answer:

(B) Real Account

Question 29.

Income and Expenditure Account is prepared :

(A) By Business Organisation

(B) By Industrial Organisation

(C) By Not-for-Profit Organisation

(D) By all Organisations

Answer:

(C) By Not-for-Profit Organisation

Question 30.

Payment of honorarium to secretary is treated as :

(A) Capital expenditure

(B) Revenue expenditure

(C) Cash expenses

(D) None of these

Answer:

(B) Revenue expenditure

Question 31.

Outstanding subscription is a/an:

(A) Income

(B) Expense

(C) Liability

(D) None of these

Answer:

(A) Income

![]()

Question 32.

Legacies should be treated as a:

(A) Liability

(B) Capital

(C) Revenue Receipt

(D) None of these

Answer:

(A) Liability

Question 33.

The excess of assets over liabilities in non-trading concerns is termed as:

(A) Capital Fund

(B) Capital

(C) Profit

(D) Net Profit

Answer:

(A) Capital Fund

Question 34.

For a non-trading concern, honorarium ¡s a/an:

(A) Income

(B) Asset

(C) Expense

(D) None df these

Answer:

(C) Expense

Question 35.

Entrance fees, unless otherwise stated, ¡s treated as:

(A) A Capital Receipt

(B) A Revenue Income

(C) Expense

(D) None df these

Answer:

(B) A Revenue Income

Question 36.

In the absence of partnership deed, the partner shall he

allowed interest on the amount advanced to the firm:

(A) @5%

(B) @6%

(C) @9%

(D) @8%

Answer:

(B)@6%

![]()

Question 37.

Which one is not the feature of partnership ?

(A) Agreement

(B) Sharing of Profit

(C) Limited Liability

(D) Two or more than two

Answer:

(C) Limited Liability

Question 38.

In the absence of partnership deed, interest on capital will be given to the partners at:

(A) 8% p.a.

(B) 6% p.a.

(C) 9% p.a.

(D) None of these

Answer:

(D) None of these

Question 39.

Current Account is:

(A) Personal Account

(B) Real Account

(C) Nominal Account

(D) None of these

Answer:

(A) Personal Account

![]()

Question 40.

The interest on Partner’s Capital Account under fluctuating method is to be credited to:

(A) Profit & Loss A/c

(B) Interest A/c

(C) Partners’ Capital A/c

(D) None of these

Answer:

(C) Partners’ Capital A/c

Question 41.

When debentures are issued as collateral security, which entrey has to be passed:

(A) Debenture Suspense A/c . . .Dt.

To Debentures

(B) No entry has to be made

(C) (A) or (B)

(D) None of these

Answer:

(C) (A) or (B)

Question 42.

Analysis of financial statements involve :

(A) Trading A/c

(B) Profit & Loss Statement

(C) Balance Sheet

(D) All the above

Answer:

(D) All the above

Question 43.

Which of the following is a non-profitable organisation ?

(A) Jharkhand Academic Council

(B) Tata Steel

(C) Air India

(D) Jat Airways

Answer:

(A) Jharkhand Academic Council

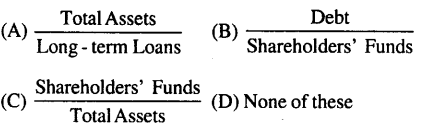

Question 44.

Proprietory ratio is calculated by the following formula:

Answer:

(C)

![]()

Question 45.

The balance of Joint Life Policy Account and Joint Life Policy Reserve A/c is always :

(A) Equal

(B) Unequal

(C) Not Necessary

(D) None of these

Answer:

(C) Not Necessary

Question 46.

Assets and Liabilities are shown at their revalued values in:

(A) New Balance Sheet

(B) Revaluation A/c

(C) All Partners’ Capital A/c

(D) Realisation A/c

Answer:

(A) New Balance Sheet

Question 47.

A company has…………..

(A) Separate Legal Entity

(B) Perpetual Existence

(C) Limited Liability

(D) All the above

Answer:

(D) All the above

![]()

Question 48.

A company should transfer to Debenture Redemption Reserve A/c at least what percent of the amount of debentures issued before the commencement of redemption of debentures:

(A) 50%

(B) 25%

(C)15%

(D) 100%

Answer:

(A) 50%

Question 49.

An annual report is issued by company to its :

(A) Directors

(B) Auditors

(C) Shareholders

(D) Management

Answer:

(D) Management

Question 50.

What will be the value of good will at twice the average of last three years profit if the profits of the last three years were 4,000 Rs, 5,000 Rs and 6,000 Rs :

(A) 5,000 Rs

(B) 10,000 Rs

(C) 8,000 Rs

(D) None of these

Answer:

(B) 10,000 Rs