BSEB Bihar Board 12th Accountancy Important Questions Short Answer Type Part 4 are the best resource for students which helps in revision.

Bihar Board 12th Accountancy Important Questions Short Answer Type Part 4 in English

Question 1.

Write any three differences between equity shares and preference shares.

Or, Distinguish between Equity Shares and Preference Shares.

Answer:

Difference between Preference Shares Equity shares: The difference between preference shares and equity shares are as under:

Question 2.

State any three features of a company.

Answer:

Essential features of a Company : Following are the essential features (characteristics) of a company :

- Association of Persons : A company is an association of persons, usually for profit.

- Artificial Person : It is an artificial person created by law.

- Separate Legal Entity: It has a separate legal entity from its members. So it can use and can be used in its own name. It can own or dispose of property in its own name.

Question 3.

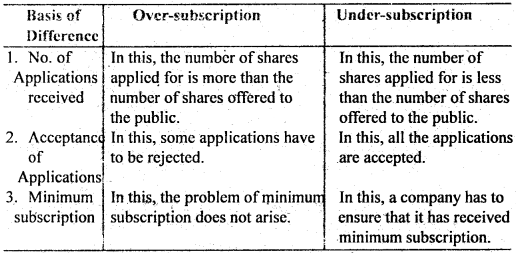

Distinguish between Over-subscription and Under-subscription?

Answer:

Distinguish between Over-subscription and Under-subscription

Question 4.

What are the provisions of reservation for Small Applicants (Investors) by SEBI?

Answer:

Reservation for Small Applicants (Investors): In case of over-subscription of shares, as per SEBI guidelines, the following reservation for small individual applications should be kept in mind :

(a) A minimum of 50% of the net offer to public, should be initially made to individual applicants who have applied for 10 or less than 10 marketable lots of the securities offered.

(b) The remaining net offer to public shall be allotted to :

- The individual applicants who have applied for more than 10 marketable lots of the securities; and

- Other investors including corporate bodies or institutions irrespective of the number of shares applied for.

(c) The unsubscribed portion of the net offer made to any of the above mentioned two categories shall may be allotted to other categories. The allotment is to made in marketable lots separately on proportionate basis.

Question 5.

What is Buy-back of Shares?

Answer:

Buy-back of Shares : A company may buy its own shares from market subject to certain conditions (Sec. 77A). This is known as ‘buy-back’ of shares. Buy-back of equity shares results in the cancellation of share capital and thereby leading to the reduction, in the share capital of the company.

Buy-back of its own shares may be made out of the following :

- Free reserves of the company, e.g., general reserve, reserve fund, credit balance of Profit & Loss A/c.

- The proceeds of any shares or other specified securities.

- Securities Premium Account.

Question 6.

Distinguish between Revaluation Account and Realization Account.

Answer:

Difference between Revaluation Account and Realization

Realization Account:

- This account is prepared at the time of dissolution of the firm.

- It is prepared to find out profit/loss on the sale of assets and repayment of liabilities.

- After preparation of realization account there will be no business afterwards.

- Realization Account is prepared only once during the lifetime a firm.

Revaluation Account:

- This account is prepared during the reconstitution of the partnership.

- It is prepared to make necessary adjustment regrading revaluation of assets and liabilities.

- After preparing revaluation account business of the firm can be continued.

- Revaluation Account may (if required) be prepared a number of times during the life-time of the firm.

Question 7.

What is over subscription of shares?

Answer:

Over subscription : when the application money is received for more number of share than the number of shares offered to the public by a company, It is called over subscription. When the shares are over-subscribed, the company cannot satisfy all the applicants. This is due to the reason that the tolal number of shares to be allotted will no case exceed number of shares offered.

Question 8.

What is forfeiture of shares. ?

Answer:

When shareholder fail to pay allotment or instalment money on shares allotted to them the company has authority to forfeit shares of the defaulters. This is called forfeiture of shares. In case of forfeiture of shares the amount already paid by defaulting shareholder is forfeited by the company.

Question 9.

Define prospectus.

Answer:

Prospectus: Prospectus may be defined as any notice, circular, advertisement or any other document inviting offers from the public for the purchase of its shares or debentures or for making deposits with it. Thus, a purchase is issued by a company to the public to raise funds. It explains the prospeptus of the company to the general public. Its purpose is to arouse the interest of the investors in the company. It serves as invitations to the public to make deposits with the company or invest in the shares and debentures issued by it.

Question 10.

Distinguish between Revenue profit and capital profit.

Answer:

Revenue Profit: Revenue profit is the money the business earns through its particular trade. A retail store that sells goods, For example, earns revenue profit when sales of those goods occur. Revenue profit also includes money earned from investments and commission.

Capital Profit: Capital profit is money brought into the company primarily through internal measures. It is profit that is not earned in the regular course of the business. Capital profit includes items such as income from sales of a fixed assets, income from sales of premium share of stock etc.

Question 11.

Distinguish between Receipts and payments A/c and Cash Book.

Answer:

Distinguish between Receipts and payments A/c and Cashbook are as follows :

Receipts and Payments A/c:

- Entries are not made date-wise.

- Entries are made in classified form.

- This account is prepared at the end of accounting year.

- This is prepared by not-for-profit organisations.

- There is no column of ledger folio.

Cash Book:

- All entries are made date-wise.

- Entries are made in chronological order.

- Cashbook is recorded on daily basis

- This is prepared by all the organisations, trading and non-trading.

- This has a separated column for- ledger folio.

Question 12.

What is Unlimited liability?

Answer:

Unlimited liability refers to the legal obligations general partners and sale proprietors because they are liable for all business debtsif the business can’t pay its liabilities. General partners and sole proprietors are responsible for paying off all of the company debts. Personally if the company can’t make its payments.

Question 13.

What do you mean by issue of shares at discount? State the provisions of Companies Act related to shares issued at discount.

Answer:

Shares issued at Discount [Sec. 79]:

Meaning: When shares are issued at a price less than their face value (or nominal value) it is said that they have been issued at discount. For example, if a share of ₹ 10 is issued for ₹ 9, ₹ 1 (₹ 10 – 9) will be treated as discount on issue of shares.

Conditions of Section 79 for issue of shares at Discount:

A company is allowed to issue shares at a discount if the following conditions are fulfilled:

1. The shares must be of a class already issued.

2. The issue of shares at a discount is authorised by a resolution passed by the company and sanctioned by the Company Law Board.

3. The resolution must specify the maximum rate of discount at which the shares are to be issued. The rate of discount must not exceed 10%.

The rate may exceed 10% only if the Company Law Board is of the opinion that a higher percentage of discount may be allowed in the special circumstances of the case.

4. At least one year has elapsed since the company was entitled to commence the business.

5. The issue must be made within two months later receiving sanction from the Company Law Board or within such extended time as the Company Law Board may allow.

Discount on issue of shares is a nominal account. Since it represents a capital loss it is prudent to write it off gradually out of profits over a reasonable number of years.

Question 14.

Shiv Ltd, issued 40,000 equity shares of ₹ 10 each payable as follows :

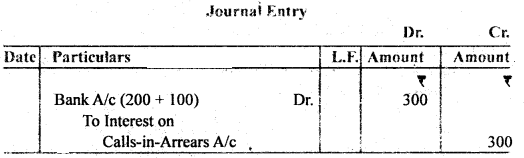

On Application ₹ 2 (June 1), on Allotment ₹ 3 (August 1), on First call ₹ 3 (October 1) and on Final call ₹ 2 (December 1) Om who holds 4,000 shares, paid allotment and first call money including interest with second call. Company prescribed Table A. Calculate interest on calls in a year and give Journal entries of interest Accounts are closed on 31st December every year.

Answer:

Call-in-Arrears on allotment on 4,000 shares of Om = 4,000 × 3 = ₹ 12,000

Calls-in-Arrears on first call on 4,000 shares of Om = 4,000 × 3 = ₹ 12,000

Calculation of Interest on Calls-in-Arrears :

(i) Interest on arrears on Allotment = 12,000 × \(\frac{5}{100} \times \frac{4}{12}\) = ₹ 200

(ii) Interest on arrears on First Call = 12,000 × \(\frac{5}{100} \times \frac{2}{12}\) = ₹ 100

Question 15.

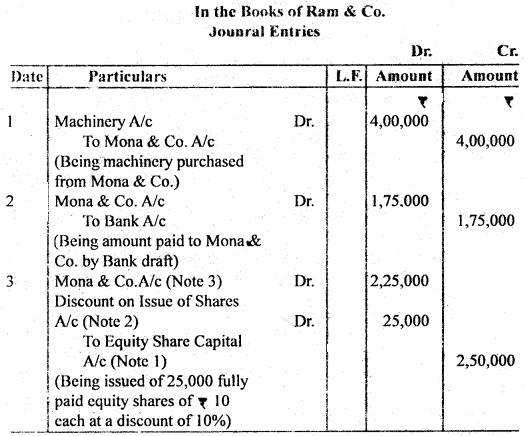

Ram & Co. purchased machinery from Mona & Co. for ₹ 4,00,000. A sum of ₹ 1,75,000 was paid by the means of a bank draft and for the balance due Ram & Co., issued Equity Shares of ₹ 10 each at a discount of 10%.

Journalise the above transactions in the hooks of the company.

Answer:

Working Notes :

2. Discount = 2,50,000 × \(\frac {10}{100}\) = ₹ 25,000

3. ₹ 4,00,000 – 1,75,000 = ₹ 2,25,000

or, ₹ 2,50,000 – 25,000 (Discount) = ₹ 2,25,000

Question 16.

What is Redemption of Debentures?

Answer:

Meaning of Redemption of Debentures :

Redemption of debentures means discharge of liability on account of debentures. Usually, debentures are redeemed at the expiry of their life in accordance with the terms and conditions. The terms are clearly stated in Debenture Certificate. So a company is under obligation to make payment Of the amount due on debentures to the debenture holders.

The following three major issues should be dealt with by a company regarding redemption of debentures :

- Determination of Time of Redemption;

- Computation of Amount of Redemption;

- Determination of the Sources of Redemption.

Question 17.

State any three objectives of Financial Statement

Or, What are the objectives of Financial Statements?

Answer:

There are following objectives of Financial Statements :

- To serve as a media of information regarding profitability and financial health of the enterprise.

- To assist in investment decision-making.

- To help in planning.

- To help management in assessing the efficiency of the organisation.

- To provide financial information about economic resources and obligations of a business enterprise.

- To provide reliable information about changes in net resources (that is, resources less obligations) arising out of business activities.

- To assist in estimating the earnings-potentials of the business.

- To disclose other information that is relevant to the needs of the users of the financial statements.

Question 18.

What is Financial Statements?

Or, What do you mean by Financial Statements?

Answer:

Meaning of Financial Statements: The end product of financial accounting is financial statements. Financial Statements are organised summaries of detailed information about financial position and performance an enterprise for a particular period. Financial Statements are also called financial reports. The financial information of an enterprise is contained in the financial statements or accounting reports. The term ‘Financial Statements’ normally refer to two basic statements, namely:

- Balance Sheet (or Statement of Financial Period),

- Profit & Loss Account (or Income Statement).

According to John N. Myer, “The financial statements provide a summary of the accounts of a business enterprise, the Balance Sheet reflecting the assets, liabilities and capital as on a certain date and the income statement showing the results of operation during a certain period.”

Question 19.

What is meant by Financial Statement Analysis?

Or, Explain the meaning of Analysis of Financial Statement.

Answer:

Meaning of Analysis of Financial Statements : Analysis is the process of critically examining the accounting information given in financial statements. For the purpose of analysis, individual items are studied, their inter-relationship with other related figures is established. Sometimes the data are re-arranged to have a better understanding of the information with the help of different techniques or tools for the purpose.

Hence, analysis of financial statement is a process of evaluating relationship between component parts of financial statements to obtain a better understanding of the information with the help of different techniques or tools for the purpose. Hence, analysis of financial statement is a process of evaluating relationship between component parts of financial statements to obtain a better understanding of firm’s position and performance.

In the words of Finley and Miller, “Financial analysis consists of separating facts according to some definite plan, arranging them in groups according to certain circumstances and then presenting them in a convenient and easily readable and understandable form.”

Thus, analysis of financial statement implies classifying, arranging and comparing the information given in financial statements.

Question 20.

Explain the features of Financial Analysis.

Answer:

Features of Financial Analysis: The following are the features of financial analysis :

- To present the complex accounting data in simple and understandable form.

- To classify the items given in Profit & Loss Account in convenient and related groups.

- To classify the items given in the Balance Sheet in convenient and related groups.

- To make comparisons between different groups to interpret different conclusions.

- To convert the mass of financial data into useful information which is always in scarce supply.

Question 21.

Write the objectives of Analysis of Financial Statements.

Answer:

Objectives or Purposes of Financial Analysis: The main objectives (or purposes) of analysis of financial statements are as follows :

- To assess the present and future earning capacity or profitability.

- To assess the operational efficiency of the concern as a whole or of its various parts or departments.

- To assess the short-term solvency of the concern.

- To assess the long-term solvency of the concern.

- To compare intra-firm position and inter-firm position.

- To locate the areas of efficiency or deficiency.

- To assess the financial stability of a business concern.

- To assess the long-term liquidity of its funds.

- To determine the value of business,

- To determine the value of goodwill.

- To assess the possibility of developments in the future by making forecasts and preparing budgets.

- To judge the efficiency of management.

- To take corrective action on the basis of information so gathered.