Bihar Board 12th Economics Model Papers

Bihar Board 12th Economics Model Question Paper 4 in English Medium

Time : 3 Hour. 15 Min

Full Marks : 100

Instructions

- Candidates are required to give their answers in their own words as far as practicable.

- Figures in the right hand margin indicate full marks.

- 15 minutes of extra time has been allotted for the candidate to read the questions carefully.

- This question paper has two sections : Section-A and Section-B.

- In Section-A, there are 50 objective type questions which are compulsory, each carrying 1 mark. Darken the circle with black/blue ball pen against the correct option on OMR Sheet provided to you Do. not use Whitener/Liquid/Blade/Nail on OMR Sheet, otherwise the result will be treated as invalid.

- In Section-B, there are Non-objective type questions. There are 25 Short answer type questions, out of which any 15 questions are to be answered. Each question carries 2 marks. Apart forms this, there are 08 Long answer type questions, out-of which any 04 of them are to be answered. Each questions carries 5 marks.

- Use of any electronic device is prohibited.

Objective Type Questions

Question No. -1 to 50 have four options provided, out of which only one is correct. You have to mark, your selected option, on the OMR-Sheet. Each questiion carries 1 (one) mark. [50 x 1 = 50]

Question 1.

Who. said “Economics is a science of Wealth” ?

(a) Marshall

(b) Robbins

(c) Adam Smith

(d) J. K. Mehta

Answer:

(c) Adam Smith

Question 2.

Micro-economics includes __________

(a) individual unit

(b) small units

(c) individual price determination

(d) all of these

Answer:

(d) all of these

![]()

Question 3.

Which of the following statements is true ?

(a) Human wants are infinite

(b) Resources are limited

(c) Scarcity problem gives birth to choice

(d) All of these

Answer:

(d) All of these

Question 4.

The name of the curve which shows economic problem is __________

(a) Production curve

(b) Demand curve

(c) Indifference curve

(d) Production possibility curve

Answer:

(c) Indifference curve

Question 5.

With rise in price of, coffee the demand of tea __________

(a) rises

(b) falls

(c) remains stable

(d) none of these

Answer:

(a) rises

Question 6.

Goods, which can be alternatively used, are called __________

(a) Complementary goods

(b) Substitute goods

(c) Comfort goods

(d) None of these

Answer:

(b) Substitute goods

Question 7.

Long-run production function is related to __________

(a) Law of demand

(b) Law of increasing returns

(c) Law of returns of scale

(d) Elasticity of demand

Answer:

(c) Law of returns of scale

Question 8.

The alternative name of opportunity cost is __________

(a) Economic cost

(b) Equilibrium price

(c) Marginal cost

(d) Average cost

Answer:

(a) Economic cost

Question 9.

The first condition of firm’s equilibrium is __________

(a) MC = MR

(b) MR = TR

(c) MR = AR

(d) AC = AR

Answer:

(a) MC = MR

Question 10.

The reason of decrease in supply is __________

(a) increase in production cost

(b) increase in price substitutes

(c) fall in number of firms in the industry

(d) all of these

Answer:

(d) all of these

Question 11.

When supply increase more with a result of small increase in price, the nature of supply will be __________

(a) elastic

(b) inelastic

(c) perfectly inelastic

(d) perfectly elastic

Answer:

(a) elastic

Question 12.

What does a monopolist market show?

(a) production process

(b) Distribution system

(c) Nature of market

(d) None of these

Answer:

(c) Nature of market

Question 13.

Market situation where there is only one buyer is __________

(a) Monopoly

(b) Monopsony

(c) Duopoly

(d) None of these

Answer:

(b) Monopsony

Question 14.

Which factor determines equilibrium price ?

(a) Demand for commodity

(b) Supply of commodity

(c) Both (a) and (b)

(d) None of these

Answer:

(c) Both (a) and (b)

Question 15.

Market price is found in __________

(a) short period market

(b) long period market

(c) very long period market

(d) none of these

Answer:

(a) short period market

Question 16.

Which is the component of factor price deter-mination ?

(a) Rent

(b) Wages

(c) Interest

(d) All of these

Answer:

(d) All of these

Question 17.

General price level is studied in __________

(a) Micro-Economics

(b) Macro-Economics

(c) Both (a) and (b)

(d) None of these

Answer:

(b) Macro-Economics

Question 18.

Which one is the limitation of Macro Economics ?

(a) Collective Economic Paradox

(b) Ignores Individual Units

(c) Both (a) and (b)

(d) None of these

Answer:

(c) Both (a) and (b)

![]()

Question 19.

Macro-Economics studies __________

(a) Employment opportunities in economy

(b) Theory of supply of commodities

(c) Elasticity of demand in scooter

(d) Price of wheat in market

Answer:

(a) Employment opportunities in economy

Question 20.

Primary sector includes __________

(a) Agriculture

(b) Retail trading

(c) Small industries

(d) All of these

Answer:

(a) Agriculture

Question 21.

Which one is included in National Income ?

(a) Rent, wage, interest

(b) Rent, wage, salary

(c) Rent, profit, interest

(d) Rent, wage, salary, interest, profit

Answer:

(d) Rent, wage, salary, interest, profit

Question 22.

Depreciation expenses are included in __________

(a) GNPMP

(b) NNPMP

(c) NNPFC

(d) None of these

Answer:

(c) NNPFC

Question 23.

Which service is included in Tertiary Sector ?

(a) Mining

(b) Construction

(c) Communication

(d) Animal Husbandry

Answer:

(c) Communication

Question 24.

Which one is a component of profit ?

(a) Dividend

(b) Undistributed Profit

(c) Corporate Profit Tax

(d) All of these

Answer:

(d) All of these

Question 25.

The function of money is __________

(a) Medium of exchange

(b) Measure of value

(c) Store of value

(d) All of these

Answer:

(d) All of these

Question 26.

“Money is what money does.” Who said it ?

(a) Keynes

(b) Prof. Thomas

(c) Hawtrey

(d) Hartley Withers

Answer:

(d) Hartley Withers

Question 27.

Which one is the Bank of the Public ?

(a) Commercial Bank

(b) Central Bank

(c) Both (a) and (b)

(d) None of these

Answer:

(a) Commercial Bank

Question 28.

Credit money is increased when CRR __________

(a) falls (b) rises

(c) both (a) and (b)

(d) none of these

Answer:

(a) falls (b) rises

Question 29.

Reserve Bank of India was established in __________

(a) 1947

(b) 1935

(c) 1937

(d)1945

Answer:

(b) 1935

Question 30.

Monetary policy is related with __________

(a) Public expenditure

(b) Taxes

(c) Public debt

(d) Open market operations

Answer:

(d) Open market operations

Question 31.

Banking Ombudsman Scheme was announced in the year __________

(a) 1990

(b) 1995

(c) 1997

(d) 2000

Answer:

(b) 1995

Question 32.

Who is the custodian of Indian Banking system ?

(a) Reserve Bank of India

(b) State Bank of India

(c) Unit Trust of India

(d) LIC of India

Answer:

(a) Reserve Bank of India

Question 33.

“Supply creates its own demand.” Who said it ?

(a) J.B. Say

(b) J.S. Mill

(c) Keynes

(d) Ricardo

Answer:

(a) J.B. Say

![]()

Question 34.

Which statement is true ?

(a) MPC + MPS = 0

(b) MPC + MPS < 1

(c) MPC + MPS = 1

(d) MPC + MPS > 1

Answer:

(c) MPC + MPS = 1

Question 35.

On which factor does Keynesian Theory of Employment depend ?

(a) Effective demand

(b) Supply

(c) Production efficiency

(d) None of these

Answer:

(a) Effective demand

Question 36.

Who is the writer of the book Traited Economic Politique ?

(a) Pigou

(b) J. B. Say

(c) J. M. Keynes

(d) Ricardo

Answer:

(b) J. B. Say

Question 37.

Increase in aggregate demand of equilibrium level of income and production causes increase in

(a) employment

(b) production

(c) income

(d) all of these

Answer:

(d) all of these

Question 38.

Which of the following is a reason of appearing surplus demand ?

(a) Increase in Public expenditure

(b) Increase in Money supply

(c) Fall in taxes

(d) All of these

Answer:

(d) All of these

Question 39.

Budget may include __________

(a) Revenue deficit

(b) Fiscal deficit

(c) Primary deficit

(d) All of these

Answer:

(d) All of these

Question 40.

Which items are included in Balance of Pay-ments ?

(a) Visible items

(b) Invisible items

(c) Capital transfers

(d) All of these

Answer:

(d) All of these

Question 41.

The main reason of operating the law of increasing return is __________

(a) size efficiency

(b) specialisation

(c) indivisibility

(d) all of these

Answer:

(c) indivisibility

Question 42.

Which of the following is the formula for measuring the elasticity of supply ? Q

Answer:

(c) \(\frac { Q }{ ∆P }\) × ∆P

Question 43.

NNPmp = ?

(a) GNPmp- Depreciation

(b) GNPmp +Depreciation

(c) GNPmp+ Indirect tax

(d) None of these

Answer:

(a) GNPmp- Depreciation

Question 44.

Who is the writer of the book “General Theory of Employment, Interest and Money” ?

(a) Pigou

(b) Malthus

(c) J.M. Keynes

(d) Marshall

Answer:

(c) J.M. Keynes

Question 46.

Keynesian multiplier principle establishes relationship between

(a) Investment and Income

(b) Income and Consumption

(c) Savings and Investment

(d) None of these

Answer:

(a) Investment and Income

Question 47.

Which of the following is the equilibrium condition for circular flow in four sector flow ?

(a) C + I

(b) C +1 + G

(c) C + 1 + G + (X- M)

(d) None of these

Answer:

(c) C + 1 + G + (X- M)

Question 48.

The sum of market prices of all final goods and services produced by the producers in the domestic territory of a country in an accounting year is known as

(a) GDPmp

(b) GDPfc

(c) NNPpc

(d) None of these

Answer:

(a) GDPmp

Question 49.

Which of the following is a real investment ?

(a) Purchasing of a share

(b) Purchasing of an old factory

(c) Construction of buildings

(d) Opening deposit account in the bank

Answer:

(c) Construction of buildings

Question 50.

The value of Keynesian Investment Multiplier depends on

(a) Income level

(b) Marginal productivity of capital

(c) Marginal propensity of consumer

(d) Investment level

Answer:

(d) Investment level

Non-Objective Type Questions

Short Answer Type Questions

Question no. 1 to 25 are Short answer type questions. Answer any 15 out of them. Each question carries 2 marks. (15 x 3 = 30)

Question 1.

Distinguish between Giffen goods and Inferior goods.

Answer:

- Normal goods (Giffen goods) : Normal goods are those goods for which the demand rises with every increase in the income of consumer. In other words, in case of normal goods, there is a direct relationship between income of a consumer and his demand for normal goods e.g. the demand for rice and wheat will increase with very increase in income. Thus, rice and wheat are normal goods.

- Inferior goods : Inferior goods are low quality products and their demand decrease when income of consumer increases and vise versa. In other words, in case of interior goods, there is an inverse relationship between demand and income of consumer e.g. the demand for pea nuts or bajra will full with the rise of the income of the consumer. Hence pea nuts and bajra become inferior goods at a higher level of income.

![]()

Question 2.

What is price elasticity of demand ? How is it measured ?

Answer:

Price elasticity of demand or elasticity of demand

According to Marshall,” The. elasticity (or responsiveness) of demand in a market is great or small according as the amount demanded increases much or little for a given fall in price, or diminishes much or little for a given rise in price.”

According to Samuelson.” This is a concept devised to indicate the degree of responsiveness of quantity demanded to changes in market prices.”

It is clear that:

“Price elasticity of demand may be defined as the percentage change in the quantity demanded of a commodity divided by the percentage change in price of that commodity.”

Elasticity of demand = \(\frac { Proportionate change in quantity demanded }{ Proportionate change in price. }\)

Question 3.

What is Capital Adequacy Ratio Criteria ?

Answer:

Capital Adequacy Ratio Criteria : Capital adequacy ratio critieria applies for commerical bank. Under this scheme, it is compulsory to get 8% CAR for all banks working in India. All the public banks of country have got this capital adequacy ratio (CAR).

Question 4.

What is seasonal unemployment ?

Answer:

Seasonal Unemployment: Many of factories or industries work on seasonal basis. When working season on pick point they hire workers or they give employment and the other hand when season rise on pick off or-when season off they voluntary loose their workers or they spread unemployment this process is called seasonal unemployment.

Question 5.

What are deposits ?

Answer:

Deposit : It refers to those amount which accepted by banks and deposited by public for security of wealth and earning purpose. Banks take deposit from public and give a certain rate of interest.

Question 6.

Define Clearing house.

Answer:

By clearing house function of central bank we mean that, “Setting the claims of various banks against each other with least use of cash.”

Question 7.

What is progressive tax ?

Answer:

The Rate of tax decreases while income increases, in progressive system.

Question 8.

What is exchange rate ?

Answer:

Exchange rate expresses the ratio of exchange between the currencies of two countries. Hence, exchange rate is the price of a country expressed in terms of another currency.

Question 9.

Distinguish between inflationary and deflationary gap.

Answer:

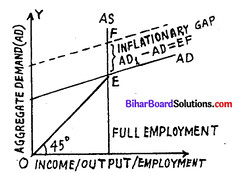

“Inflationary gap is the measure of the amount by which aggregate demand exceeds the level of Aggregate demand required to maintain full employment.” “Deflationary gap, when difference occures between unsufficient supply and unsufficient demand is called deflationary gap.”

Question 10.

“Excess demand shows inflationary gap.” Clarify.

Answer:

Excess demand implies inflationary Gap : “Inflationary gap is the measure of the amount by which aggregate demand exceeds the level of aggregate demand required to maintain full employment equilibrium.”

In other words the difference between aggregate demand and aggregate supply is called inflationary gap. On situation of inflationary gap production in the economy dos not increase only prices rise i.e. at the point of full employment, production becomes constant and prices start rising. In inflationary pressure emerges in the economy.

Question 11.

What is the relationship between primary deposits and derived deposits ?

Answer:

- Primary Deposits : Primary deposits refers to that deposit which is deposited in form of real money by banks.

- Derived deposits : On the contrary when banks give loan to any person then that bank takes deposits of that loan in the account of that person in their own bank and deposited amount written by bank in that account is called derived deposits.

Question 12.

What is the role of bank rate in credit control ?

Answer:

The most important function of the central bank is to control the credit activities of commercial banks. Credit control refers to the increases or decrease in the value of credit money in accordance with the monetary requirement of the country. More expansion of credit money than necessary leads to the situation of inflation greater contraction of credit money on the other hand, might create a situation of deflation.

Question 13.

Explain the properties of money.

Answer:

Following are the merit or quality of good money :-

- Utility :- The metal with which coin is made, must bear the feature of utility.

- Portability :- The metal, with which coin is made, can easily be transferred from one place to another. Gold and silver coins bear this feature also.

- Durable :- Money is saved by people and hence, coin should be made of such metal which is durable from saving purpose.

- Divisibility:- Money metal should be divisible without any loss in its. Gold and silver are such metals having the feature of divisibility.

- Homogeneity:- All units of money should be homogeneous.

- Economy Minting cost of coin should be minimum and the depreciation in the coin should be least.

- Stability of value Money metal should be stable in value i.e. price fluctuation in the metal of coin should be minimum.

- Liquidity:- Money metal should be liquid in nature. Metal should easily be converted into coins and coins can be again be converted into metal easily.

- Congnisibility :- Metal should easily be identified. Take coins can easily be traced out if metal of money is cognisible. Gold and silver are such metals having full congnisibility.

![]()

Question 14.

What is Budget ? Discuss Performance Budget and Gender Budget.

Answer:

Budget is a detailed economic statement which includes the details of income and expenditure of the government. According to Rene Stoum, “The budget is a document containing a preliminary approaval plan of public revenue and expenditure.”

- Revenue budget : The revenue budet consists of revenue receipts of the governments and the expenditure met from rush revenues. The receipts includes tax revenue and non-tax revenue.

- Capital budget: The capital budget consists of capital recepits and capital revenue of the Government.

Question 15.

Distinguish between fixed and flexible exchange rate.

Answer:

Difference between Fixed Exchange Rate and Flexible Exchange Rate are following :

- Fixed Exchange Rate : The rate which is officially fixed in terms of gold or any other currency by the govt, such a rate does not vary with charges in demand and supply of foreign currency only the govt, has the power to charge it.

- Flexible Exchange Rate : The rate which is determined by the forces of demand and supply of foreign exchange. There is an official intervention. It is free to flucted according to to changes in demand and supply of foreign currency.

Question 16.

What is balance of Trade ? Distinguish between current account and capital account in balance of payments.

Answer:

Balance of Trade : It is defined as the difference between exports and imports of goods. It takes into account only those transactions arising out of exports and import of roads. It does not consider the exchange of services between countries.

Symbolically, BoT = Vx – Vm

Where, Vx = Value of exports.

Vm = values of imports.

Current Account: Deposits in current account are payable on demand. They can be drawn of quench without any restriction. These accounts are usually maintained by business and are used for making business payments. No interest is paid on these deposits :

Capital Account : Capital account refers to those account which is maintained the capital of proprietor.

Question 17.

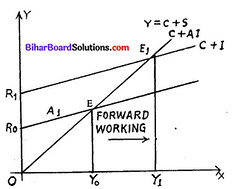

In an economy marginal propensity to consume is 0.65 and increase in investment is 90 crores of rupees. Calculate increase in total income and consumption expenditure.

Answer:

Multipler (k) = \(\frac { 1 }{ 1 – MPC }\)

= \(\frac { 1 }{ 1 – 0.65 }\) = \(\frac { 1 }{ 0.35 }\) = 5

MPS = 1 – MPC = 1 – 0.65 = 0.35

Increase in Income = K × 41

5 × 90 = rs. 45 Crores

Increase in consumption = 0.35 × 45 = 15.75 crores

Question 18.

What is the law of price elasticity of demand ?

Answer:

Law of demand

= \(\frac { Proportionate in demand community }{ Proportional change in Price }\)

Where, TR = Total Revenue

AR = Average Revenue

Q = Quantity.

Question 19.

What is cost function ?

Answer:

Cost functions expresses the relationship between production and cost function.

Question 20.

Explain the ‘micro’ and ‘macro’ levels of economic activity.

Answer:

Micro economics is concerned with an individual economic unit like a consumer,a firm ,an industry or income of an individual.lt is based on the assumption of full employment.Its central problem is price determination. What is true at micro level may not be true for macro level. lt is based on the assumption of ‘other things being equal.This analysis is based on partial equilibrium.Its objective is to study the theories related to optimum distribution of resources. Itsnature is comparatively easy. It has main instruments of demand and supply.

Macro economics deals with aggregates of economy such as national income,aggregate expenditure,tota lemployment,general price level,etc. lt is based on the assumption of under full employment of resources.Its central problem is production and employment determination.Group behaviour is applicable on entire economy.This is based on general equilibrium analysis.Its objective is to study the theories related with full employment.Its nature is comparatively complex.Its main instruments are aggregate demand .aggregate supply .aggregate saving and investment.

![]()

Question 21.

What is fiscal deficit? What are its effects?

Answer:

Fiscal deficit does not take into account all types of receipts. lt does not take into account borrowings.As such .fiscal deficit is defined as the excess of all expenditure over total receipts net of borrowings. In terms of formula,Fiscal deficit = Total budget expenditure – Total budget receipts net of borrowings.

For example,in the central government’s budget of 2002- 2003 total expenditure was Rs. 172 thousand crores while receipts other than planned borrowings were Rs.125 thousand crores.As such fiscal deficit was Rs.47 thousand crores (172- 125).Fiscal deficit indicates the total amount by which the government has to resort borrowing.

Its effects are as follows :

- It helps in increasing the amount of capital expenditure in the economy.

- Government can collect more resources for meeting out its expenditure

- It may be lead to inflationary pressure in the economy.

- High fiscal deficit generally leads to wasteful and unnecessary expenditure by the government. So, fiscal deficit should be kept as low as possible.

- The entire amount of fiscal deficit i.e.borrowings is not available for meeting expenditure because a part of it is used for interest payment.

Question 22.

What is production function ?

Answer:

A Production function expresses the technical relationship between input and output of a firm. lt tells us about the maximum quantity of output that can be produced with any given quantities of inputs.If there are two factor inputs, labour (L) and capital (K),then production function can be written as: Q = f (L,K)

Where,

Q = Quantity of output

L = Units of labour

K = Units of capital

It may be pointed here that both the inputs are necessary for the production.If any of the inputs is zero,there will be no production with both inputs and output will also be zero, As we increase the amount of any one input,output increases.

Question 23.

State the features of monopoly.

Answer:

Monopoly is the addition of two words,i.e;’Mono’+’Poly’,i.e.,single seller in the market.Being the single seller in monopoly market,a firm has full control on the supply of the commodity.In pure monopoly even no close substitute of the product is available in the market.

In monopoly ,no distinction arises between ‘firm’ and ‘ industry i.e.,firm is industry and industry is firm. According to McConnell,’ ‘Pure monopoly exists when a single firm is the sole producer of a product for which there are no close substitutes.”

Question 24.

Discuss the functions of money.

Answer:

The functions of money are as follows :

- Primary functions

- Secondly functions and

(1) Primary functions : Money has two prime functions:

- Medium of exchange : Money acts as a medium of exchange.In modem days,exchange is the basis of entire economy and money makes this exchange possible.At present money is the most liquid means of exchange.In modem times,money performs all functions of exchange in the economy.

- Measure of value : Money acts a unit of measure of value.In other words,it acts as a yardstick of standard measure of value to which all other things can be measured.

(2) Second functions: There are three secondly functions are as follows:

- Standard of deferred payments : Deferred payments mean those payments which are future.Money performs this function successfully because it is more durable as compared to other commodities .

- Store of value : Human being has a tendency to save a part of his income for future to fulfill his future requirements.

- Transfer of value : Money is a liquid means of exchange. Hence,purchasing power of money can easily be transferred from one person to another or one place to the other.

![]()

Question 25.

What is gross domestic product?

Answer:

Gross domestic product (GDP)refers to the money value of all the final goods and services produced within the domestic territory of a country.GDP is a territorial concept as it confined to domestic territoiy of a country.lt does not include net factor earning from abroad. GNP = GDP +NFYA (NFYA indicates Net factor Income from Abroa (d) .GDP is a smaller concept limited to domestic territory.

Long Answer Type Questions

Question no. 26 to 33 are Long answer type questions. Answer any 4 of them. Each question carries 5 marks. (4×5 = 20)

Question 26.

What is elasticity of supply ? Explain two methods of its measurement.

Answer:

Elasticity of supply : Elasticity of supply is the measurement of quantitative change in supply due to change in price. In other words, price elasticity of supply is the proportionate change in supply consequent upon proportionate change in price. ,

According to Marshall, “Elasticity of supply refers to the change in quantity supplied of a commodity in response to change in its price.”

Elasticity of supply (es)

= \(\frac { Proportionate change in quantity supplied }{ Proportionate change in price }\)

Measurement of supply Elasticity :

(a) Proportionate Method or Percentage Method : According to this method, elasticity of supply, (es) is the ratio between ‘Percentage change in quantity supplied’ and ‘percentage change in price’ of the commodity,

es = \(\frac { Proportionate change in quantity supplied }{ Proportionate change in price }\)

= \(\frac { change in quantity supplied }{ change in price Initial quantity }\) = \(\frac { Change in price }{ Initial price }\)

(b) Geometric method : Supply elasticity can also be measured through point method or geometric method.

Question 27.

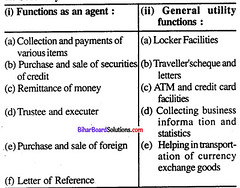

Explain important functions of a central bank.

Answer:

Functions of central Bank :

- Monopoly in Note Issue: In modern times, central bank alone has the exclusive right to issue notes in every country of the world. The notes issued by the central bank are unlimited legal tender throughout the country.

- Banker Agent and financial advisor to the government: Like general public government also needs various services and the central bank performs the same functions as banker to the government as a commercial bank provides to its customers.

- Bank of Banks : It performs the functions of a banker to all other banks in the country. Central bank has almost the same relation with all other banks as a commercial bank has with its customers. Central bank keeps part of the cash balances of all commercial banks as deposit with a view to meeting liabities of these banks in times of crises. Due to this act of the central bank, it is also called custodian of cash reserves.

- Lender of the last Resort: As banker to the bank, the central bank acts as the lender of the last resort. In other words, in case the commercial banks fail to meet their financial requirements from other words, Sources, they can, as a last resort, approach to the central bank for and advances. The central bank assists such bank through discounting of approved. Securities and bills of exchange.

- Custodian of foreign Exchange Reserves : Central bank also acts as custodian of foreign exchange reserves. It is helpful in eliminating difficulties of balance of payments and in maintaining stable exchange rate. For mininising fluctuations in foreign exchange rate, central bank buys or sells foreign exchange in the market.

- Function of Cleaning House : Central bank also performs the function of a cleaning house. By cleaning house function of central bank we mean settling the claims of various banks against each other with least use of cash.

- Credit control: The most important functions of the central bank is to control the credit activities of the commercial banks. Credit control refers to the increase or decrease in the volume of credit money in accordance with the monetary requirement of the country. More expansion of credit money than necessary leads of the situation of inflation. Greater contraction of credit money, on the other land, might create a situation of deflation.

- Development Related Functions : For promoting economic development, central bank performs following

functions:

- It extends organised banking system and establishes new financial Institution.

- It ensures sufficient money supply for development activities.

- Adopts cheap money policy for Inducing investment.

Other Functions :

- Collection of Statistics

- Relations with International financial Institutions

- (c) Survey of Banks.

- Arranging seminars.

![]()

Question 28.

What is the principle of effective demand ?

Answer:

According to keynesian employment theory in short period, total production i.e. national income in capitalist economy depends on the level of employment because in short period other factors of production such as capital, technique, etc. remain constant. Employment level depends on effective demand. That level of aggregate demand at which it becomes equal to aggregate supply is called effective demand.

Question 29.

What is the function of money ?

Answer:

Function of Money :

- Medium of exchange : Money acts as a medium of exchange. In modern days, exchange is the basis of entire economy and money makes this exchange possible. At present, money is the most liquid means of exchanges.

- Measure of value : Money acts a unit of measure of value. In other words, it acts as a yardstick of standard measure of value of which all other things can be measured.

- Store of. value : Human being has a tendency to save a part of his income for future to fulfil his future requirements. Store of value can take place only when person became confident to use his savings as per his requirements in future. Money has this merit because its utility is never lost.

- Transfer of value : Money is a liquid means of exchange, Hence, purchasing power of money can easily be transferred from one person to another or one place

to the other. Thus, in modem times has become the best means of transferring the value of money. - Basis of credit: In modem times credit has a vital role in the economy. At present credit is used as money on the basis of money, credit is issued, i.e., bank or financial institutions create credit on the basis of money. Thus, money is the basis of credit.

- Basis of Distribution of social Income : In modern times production is done on collective basis in which various factors of production-land, labour, capital, organisation perform their assigned role.

- Basis of maximum satisfaction and production : Money helps consumers in maximising theit satisfaction. A consumer maximises his satisfaction by equating the prices of each commodity with its marginal utility.

- Guarantee of solvency : Money serves as a guarantee of solevency for an individual or institution for retaining its solevency, every individual or institution prefers to keep some money ready as cash deposits. Money deposits serve as a guarantee against money.

- Bearer of option : Money serves as a bearer of option which implies that accumulating wealth in the form of money, we can change our decisions regarding the goods and services as and when the situation demands.

Question 30.

Explain Consumer’s equilibrium with the help of Indifference Curve Analysis.

Answer:

Hick and Hellen presented ‘indifference curve analysis as on alternative viewpoint of marshall’s utility Analysis.

Indifference curve analysis presents and ‘ordinal viewpoint’ in which behaviour of consumer is studied on the basis of ‘ordinal preferences. Indifference curve explains the consumer’s behaviour related with the combination of two goods and this consumer behaviour is explained with the help of’indifference schedule’ various combinations of two goods giving equal satisfaction to the consumer become the component of ‘indifference schedule’. When indifference schedule is represented on a graph paper we get indifference curve.

Consumer’s equilibrium in indifference curve analysis : A consumer obtains the state of equilibrium when he becomes successful in maximising his satisfaction by purchasing goods with his limited income and given prices of goods. The price line of the consumer is determined by his income and prices of the goods he becomes, with this given price line, a consumer tries to obtain the maximum possible indifference curve.

In difference curve analysis curve analysis there are two conditions of consumer’s equilibrium:

i.e. at the point of equilibrium, the marginal rate of substitution X and Y should be equal to the ratio of prices of goods X and goods Y.

For stable equilibrium indifference curve should be convex to the origin at the point of equilibrium, i.e.

MRSxy should be diminishing at the point of equilibrium.

In fig. at point K first conditions is getting fulfilled but this equilibrium is not stable because at the point K the MRS is increasing. In fig. point t is a point of equilibrium where MRS, is diminishing.

![]()

Question 31.

Define a commercial bank and discuss its functions.

Answer:

Commercial banks perform general banking functions. A commercial bank is an institution which deals with money and credit. lt accepts deposits from the public,makes the funds available to those who need them and helps in remittance of money from one place to another.

According to Banking Regulation Act,” Banking means the accepting for the purpose of lending and investment of deposits of money from the public,repayable on demand or otherwise, and withdrawable by cheque,draft,order or otherwise.”

Its functions are as follows :

(i) Accepting deposits : The prime function of the commercial bank is to accept deposits from bank.The various types of deposits accepts by the commercial bank are as follows:

- Current Deposits: Deposits in current account are termed as current deposits. Such account are useful for traders who need money for daily transactions many times in a day.

- Saving Deposits : Such accounts generally belong to the people having small savings and who do not require withdrawal of money many times.Interest rate in such accounts to low. such accounts promote capital formation.

- Fixed Deposits : In fixed accounts,account is deposited for a certain fixed period(which may be 46 days or more).Depositor gets deposit receipt while depositing cash in such accounts.

- Recurring account : Recurring deposits are certain type of fixed deposit. Depositor deposits a certain amount every month in this account.

(ii) Granting loans: The second important primary function of commercial banks is advancing of loans. After keeping certain cash reserves ,the banks lend their deposits to needy burrowers.

- Cash Credit : In cash credit system,bank provides loans to the borrower against bonds or some other types of securities.Businessmen deposit securities with the bank.

- Overdraft : Overdraft is permitted to those customers who have current account with the bank while cash credit can be granted to anyone.

- Loans and advances

- Discounting the bills of exchange

- Investment in government securities

(iii) Credit creation :

Question 32.

Explain the kinds of exchange rate. How are fixed and flexible exchange rates different?

Answer:

Exchange rate is mainly of two types :

- Fixed Exchange rate

- Flexible Exchange rate

Fixed rate of exchange refers to that rate of exchange which is fixed by the government. lt generally does not change or the changes can take place within a fixed limit only.

Flexible Rate of Exchange is that rate which is determined by market forces.Change in flexible exchange rate occur on account of change in market demand and supply. lt is also called floating exchange rate. Fixed Exchange rate is decided and declared by the government and it kept stable but Flexible Exchange rate is determined by demand and supply forces in international market.

In Fixed exchange rate, the central bank becomes ready to buy or sell its currencies at a fixed rate. In Flexible exchange rate is freely dependent on the working of foreign exchange market and the central bank has nothing to do with it. In fixed rate of exchange ,no fluctuation takes place but in flexible rate of exchange fluctuations appear.

![]()

Question 33.

Explain the different methods through which central bank controls credits.

Answer:

The different methods through which central bank controls credits are as follows :

- Quantitative methods

- Qualitative methods

1. Quantitative methods : It refers to those methods of credit control which are used by the central bank to influence the total volume of credit without regard for the purpose for which the credit is put.

- Bank Rate : Bank rate policy is the indirect important method for controlling credit money. The Bank rate is the rate of which the central bank is prepared to discount the first class bills of exchanges and grant loans to commercial banks.

- Open market operations : Open market operations affect the cash reserves of commercial banks.Consequently credit creation by commercial bank increases or decreases and money supply expands or contracts respectively.

- Change in cash reserve ratio (CRR): Every commercial bank has to maintain a certain ratio of its deposits with the central bank.When the cash flow or credit is to be increased,cash reserve ratio is reduced and when the cash flow or credit is to reduced,cash reserve ratio is reduced.

- Change in statutory liquidity ratio (SLR) : Every bank is required to maintain a fixed percentage of its in the form of cash or other liquid assets .called SLR.

2. Qualitative methods : This method is used by the central bank to regulate the flow of credit into particular directions of the economy.

- Rationing of credit: Central bank is the lender of last resort. So, it can adopt the measure of credit rationing for credit control.

- Regulation of consumer’s credit : In this method,the credit given to durable consumer goods is controlled.

- Change in margin requirements : Marginal requirement is the difference between the current value of physical security offered for loans and the value of loans granted.

- Direct action : Central bank can take direct action against any commercial bank if the latter do not follow central bank’s direction.