BSEB Bihar Board 12th Accountancy Important Questions Long Answer Type Part 3 are the best resource for students which helps in revision.

Bihar Board 12th Accountancy Important Questions Long Answer Type Part 3 in English

Question 1.

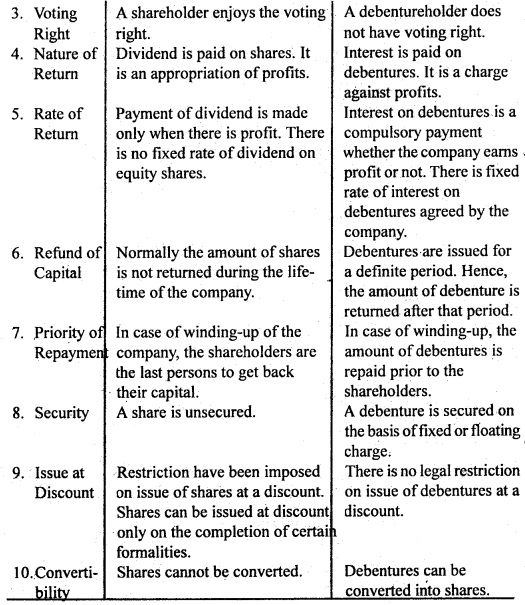

Distinguish, between a Share and a Debenture.

Answer:

Difference between a Share and a Debenture: The following table indicates the difference between a share and a debenture:

Question 2.

Describe ike various types of debentures.

Answer:

Types of Debentures: Following are the various types of Debentures:

1. Registered Debentures: The debentures which are recorded in the Register of Debenture holders are called registered debentures. Payment of interest or repayment of the principal sum will be made only to the registered holder. Such debentures are transferable only by transfer deed. In other words, it cannot be transferred by mere delivery.

2. Bearer Debentures: Bearer debentures are those which are payable to the bearer or holder. Such debentures are transferable by delivery. The payment of interest is made through the company which arc attached with the debentures. No register is maintained foç.bearer debentures.

3. Mortgage or Secured Debentures: Mortgage debentures are those debentures that are secured by creating a fixed or floating charge on the assets of the company. This means that if the company commits any default in paying interest or in repaying the principal sum, the debenture holders have the right to recover their dues from the mortgaged property. Mortgage debentures are also known as ‘Secured Debentures’. Secured debentures are those that are secured against some particular assets of the company.

Mortgage debentures may be classified as:

(a) First Debentures: These are debentures that are repayable in priority to other debentures.

(b) Second Debentures: These are debentures that are repayable only after the redemption of the first debentures.

4. Simple, Naked or Unsecured Debentures: The debentures for which the company does not offer anything by way of security are called simple or naked debentures. They are also called ‘Unsecured Debentures’. These debentures carry a fixed rate of interest and are repayable after a specified period.

5. Redeemable Debentures: Redeemable debentures are those debentures that are repayable by the company on a specified date or within a specified period. Repayment of these debentures may be in lump-sum or in instalments, depending upon the terms of the issue.

6. Irredeemable Debentures: Irredeemable debentures are those debentures that are not payable during the lifetime of the company. Such debentures become repayable only on liquidation of the company.

7. Convertible Debentures: Convertible debentures are those debentures that can be converted into shares at a specified date or within/after a specified period. Conversion takes place as per the terms of the issue.

8. Non-convertible Debentures: These are the debentures, the holders of which have no right to convert them into equity shares.

9. From coupon Rate (Interest) point of view: From the coupon rate (interest) point of view, debentures may be classified into two categories:

(a) Debentures issued with coupon rate: Debentures issued with specified rate of interest, e.g., 12% or 14% is called the coupon rate.

(b) Debentures issued without coupon rate: A debenture without coupon rate is one that does not carry a specified rate interest. It is also called as a‘Zero Coupon Bond’or‘Deep Discount Bond’.

Question 3.

A, B and C are Partners sharing profits in the ratio of 1/2 : 1/3 : 1/6 find oift new profit sharing ratio if B retires.

Answer:

Old ratio of A, B and C

= \(\frac{1}{2}: \frac{1}{3}: \frac{1}{6}=\frac{3}{6}: \frac{2}{6}: \frac{1}{6}\) = 3: 2: 1

If B retires then new Profit sharing ratio of A and C will be

= 3 : 1

Question 4.

A, B and C were partners sharing profits in the ratio of 5/6, 1/2 and 1/6. A retires and surrenders 2/3 rd of his share in favour of B and remaining in favour of C. Calculate new ratio and gaining ratio.

Answer:

Calculation of New profit sharing ratio:

A’s Share \(\left(\frac{2}{6}\right)\) will be divided between ¡3 and C in the ratio of \(\frac{2}{3}: \frac{1}{3}\)

B’s Gain = \(\frac{2}{3}\) of \(\frac{2}{6}=\frac{4}{18}\)

C’s Gain = \(\frac{1}{3}\) of \(\frac{2}{6}=\frac{2}{18}\)

New Share = Old Share + Gaining share

B’s New Share = \(\frac{1}{2}+\frac{4}{18}=\frac{9+4}{18}=\frac{13}{18}\)

C’s New share = \(\frac{1}{6}+\frac{2}{18}=\frac{3+2}{18}=\frac{5}{18}\)

New Ratio of B and C = \(\frac{13}{18}: \frac{5}{18}\) or 13 : 5

Question 5.

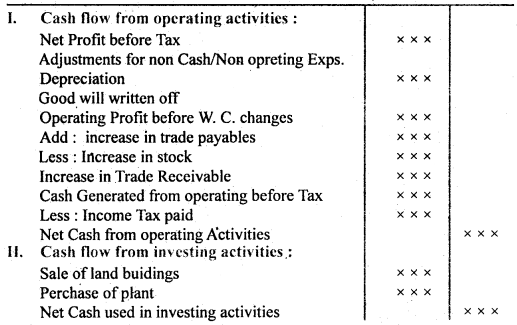

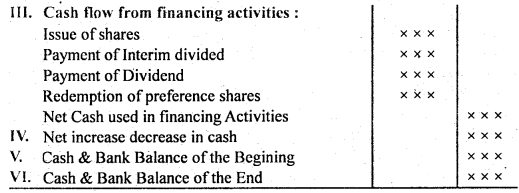

Prepare an imaginary proforma of Cashflow statement.

Answer:

Imaginary proforma of Cash Flow:

Statement

Question 6.

Calculate operating profit ratio from the following information:

Answer:

Operating Profit Ratio = \(\frac{\text { Operating Profit }}{\text { Net Revenue from operation (net sales) }}\) × 100

Operating profit = Gross Profit – Other operating exps.

= 1,50,000 – 41,000

= 1,09,000

Revenue from operating = Sales – Sales Return (Net sales)

= 4,10,000 – 10,000

= 4,00,000 (Net Sales)

∴ Operating Profit Ratio = \(\frac{1,09,000}{4,00,000}\) × 100 = 27.25%

Question 7.

Explain the major headings of the liabilities side of il: Company’s Balance Sheet as per Schedule VI.

Answer:

Explanation of Different Items of Liabilities side of Balance Sheet:

1. Share Capital: The heading ‘Share Capital’ should disclose authorised, issued, subscribed and paid-up capital stating the number and nominal value of the shares. If preference shares have been issued, the share capital will also disclose the relevant information. Calls-in-arrear is to be shown as a deduction from (he called-up amount; the amount due from directors is to be stated separately.

Calls-in-advance is to be shown as a separate item. Forfeited Shares Account must be shown as an addition to subscribed capital. Shares allotted for consideration other than cash, e.g., shares issued to vendors and shares issued as bonus shares must be separately stated.

2. Reserves and Surplus: Under this heading, all those reserves which have been created out of undistributed profits are shown.

Here these items will be shown separately:

- Capital Reserve,

- Capital Redemption Reserve,

- Securities (Share) Premium,

- Sinking Fund,

- Other Reserves,

- Balance of Profit & Loss Account (Cr.).

3. Secured Loans: Secured loans are loans that are secured against tangible assets. Debentures are always secured either on fixed charge or floating charge. Loans from banks, subsidiaries etc. are also shown under this heading if they are secured. Interest accrued and due on secured loans is also shown under this heading.

4. Unsecured Loans: Unsecured loans do not carry any charge on the assets and include fixed deposits and loans and advances from bank etc. Unsecured loans are classified into short-term loans and advances and other loans and advances. Short-term loans and advances are the loans and advances which become due for payment within one year from the date of the Balance Sheet.

5. Current Liabilities and Provisions: This heading has two sub-headings:

(a) Current liabilities: Current liabilities include the following:

- Sundry Creditors,

- Bills Payable,

- Advance Payments,

- Unclaimed Dividends, and

- Acceptances, Bank Overdraft, etc.

(b) Provisions: Provisions include the following:

- Provision for Taxation,

- Proposed Dividend,

- Provision for Contingencies,

- Provision for Provident Fund,

- Provision for Pension and Similar StafFBenefit Schemes, etc.

Provision for depreciation and provision for doubtful debts may be shown as deductions from the amounts of concerned assets.

6. Contingent Liabilities: A contingent liability is a liability that comes into existence on the happening of an uncertain event. For example, liability on account of bills discounted with the bank is a contingent liability. If contingent liabilities are not provided for in the books, they will appear below the Balance Sheet by way of footnotes under the heading contingent liabilities.

It includes the following:

- Claim against the company not acknowledged as debts.

- Uncalled liability on shares partly paid,

- Arrears of fixed cumulative dividends,

- Liabilities on Bills discounted,

- The estimated amount of contracts remaining to be executed on Capital Account and not provided for.

- Other money for which the company is contingently liable.

Question 8.

Write six limitations of Analysis of Financial Statements.

Or, Describe the limitations of Financial statements.

Answer:

Limitations of Financial Analysis: Financial analysis has the following limitations:

1. Suffering from the Limitations of Financial Statements: Financial statements suffer from a variety of weaknesses. So analysis based on these statements cannot be said to be always reliable.

2. Unreliable Comparison: There are different methods for charging depreciation and valuation of the stock. Interest may be charged at different rates. In this way, there is sufficient possibility of manipulation and the financial statements have to suffer. As a result financial analysis also proves to be defective. In fact, in many cases comparisons are unreliable.

3. Ignoring Price-level Changes: The results shown by financial statements may be misleading if price-level changes have not been accounted for. Changes in price affect the cost of production, sales and value of assets as a consequence comparability of ratios also suffers.

4. Ignoring Qualitative Aspect: Financial analysis does not measure the qualitative aspect of the business. It does not show the skill, technical know-how and efficiency of its employees and managers.

5. Financial Analysis is only a tool, not a Final Remedy: Analysis is a financial statement is a tool to measure the profitability, efficiency and financial soundness of the business. It should be noted that personal judgement of the analysis is more important in financial analysis. We should not rely on a single ratio.

6. Different Techniques of Analysis: There are so many techniques for the analysis of financial statements. Therefore, the analysis, interpretation and results are of different types. It creates confusion in the mind of the analyser.

Question 9.

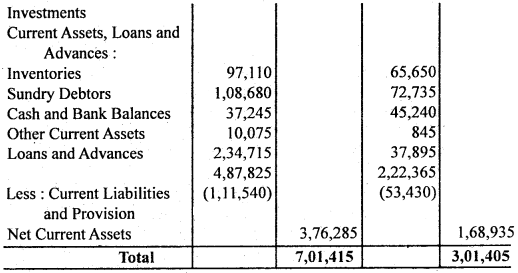

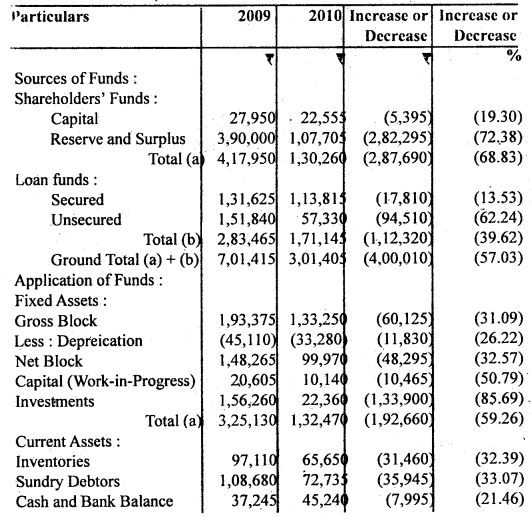

Following are the Balance Sheets of Ganesh Gee Ltd.:

Balance Sheets of Ganesh Gee Ltd.

(as on March 31, 2015, and 2016)

Prepare Comparative Balance Sheet of Ganesh Gee Ltd.

Answer:

Comparative Balance Sheets of Ganesh Gee Ltd.

(as of 31 st March 2015 and 2016)

Question 10.

State ¡he importance of Financial Analysis to User-Groups.

Answer:

Important of Financial Analysis to User-Groups: Financial statements provide useful information about the activities of a business entity to various individuals or groups. These statements are used in making judgements and decisions. The users of financial statements include owner(s), shareholders, present and potential investors, creditors, suppliers, employees, management, taxation authorities, Governments and regulatory authorities, customers, consumers, the public and others. Some of these users have a direct financial interest in the business concern whereas some users or user groups have an indirect financial interest.

The importance of financial statements to various users may be stated as ’ under:

(A) Users with Direct Financial Interest:

1. Owners/Shareholders: They are interested in knowing the earning capacity of the business, its financial soundless and the likelihood of future returns.

2. Creditors: The creditors are interested in knowing whether the company will have enough cash to pay interest charges and repay the debt at the due date. For this, the company’s liquidity and cash flow position should be analysed.

3. Suppliers: To suppliers, a business enterprise is a source of cash in the form of payment for goods or services supplied. Suppliers are interested in a company’s ability to generate adequate cash flows towards the payment of goods and services supplied. This can be decided on the basis of the analysis of the company’s financial statement.

4. Employees: Like shareholders, creditors and suppliers, the employees too have a direct financial interest in a company. Prospective and present employees may use the financial statements to assess the risk and growth potential of the company. They are interested in job satisfaction, job security, promotional avenueS, bonus declaration etc. So they want information regarding profitability etc.

5. Management: Management is one of the most important users of financial statements. Financial statements provide useful information to the management for planning, control, performance, measurement and decision-making. The analysis also helps in performing many activities and functions in the company.

(B) Users with Indirect Financial Interest:

6. Government and Regulatory Agencies governmental and regulatory agencies are concerned with the financial activities of business organisations for purposes of regulation to protect the public interest.

7. Bankers and Other Financial Institutions: Bankers and financial institutions are interested in the security of the loan advanced, equity’s capacity to repay the principal and interest as per terms. So they are interested in earning capacity and financial soundness of the company.

8. (a) Present Investors: Present investors are interested in the future growth, and financial soundness of the company. They analyse statements to determine whether they should buy, hold or sell the shares.

(b) Potential Investors: Potential investors analyse financial statements with a view to deciding whether they should buy the shares or not.

9. Other Users: The analysis of financial statements is also important from the viewpoint of consumers, stock exchanges, brokers, underwriters, economists, planners, chambers of commerce, researchers, the general public and the financial, press. They are more concerned about business enterprises as well as the effects of these enterprises that these enterprises have on the environment, social problems, inflation and quality of life. In fact, they are interested in financial analysis from their own point of view.